In a previous post, we discussed ICON’s staking reward model on a general level. While that post touched on the “un-staking period” concept, I’ve seen a lot of confusion regarding the un-staking period over the past few weeks. In this post, we’ll take an in-depth look at ICON’s un-staking period to understand what it is, and why it’s needed to maintain a secure and stable network.

What is ICON’s Un-Staking Period?

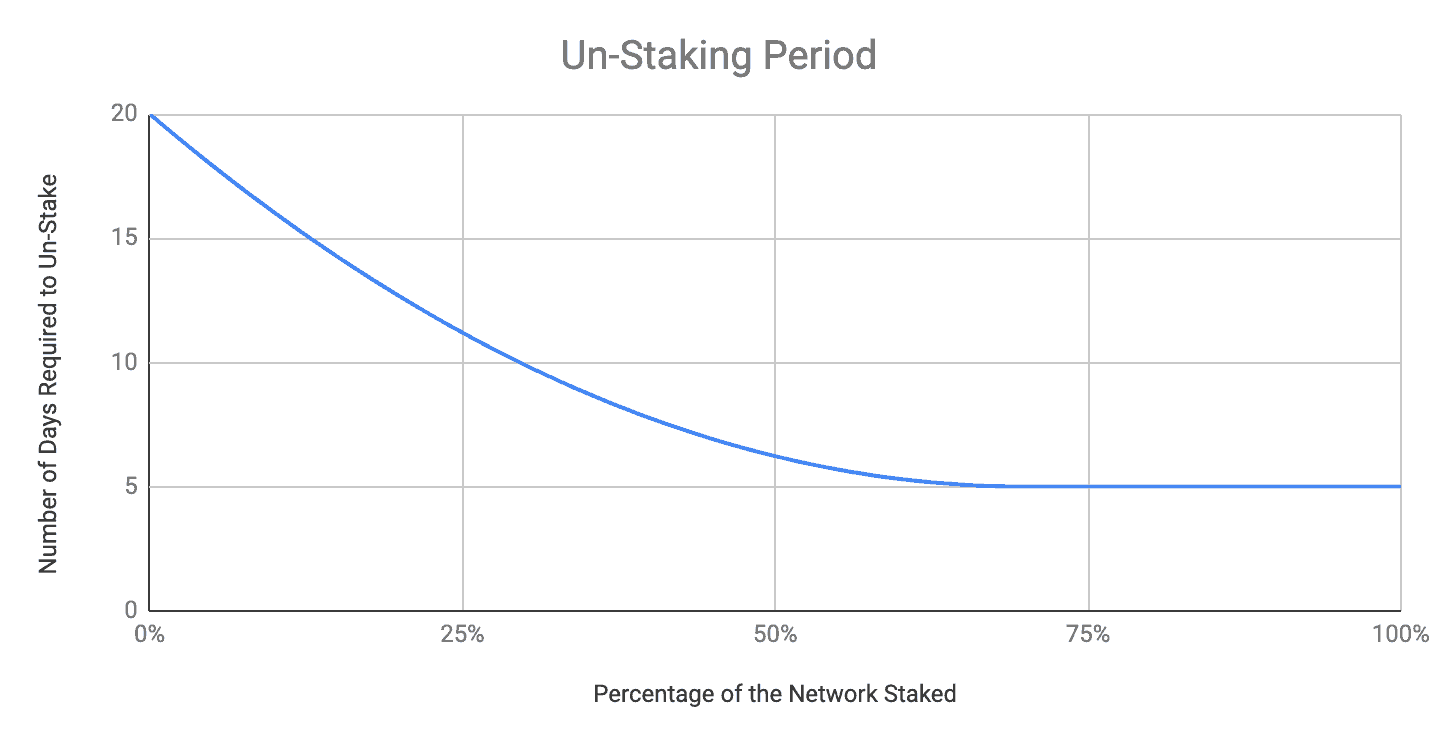

ICON’s un-staking period refers to the number of days that staked ICX is locked up in an untransferable state. During the un-staking period, an ICONist retains full custody over his or her ICX in the sense that tokens never leave the wallet – they are only delegated. However, staked ICX cannot be transferred to another wallet until after the un-staking period expires. Here is a graph that shows the curve of the un-staking period.

Source: ICON Foundation

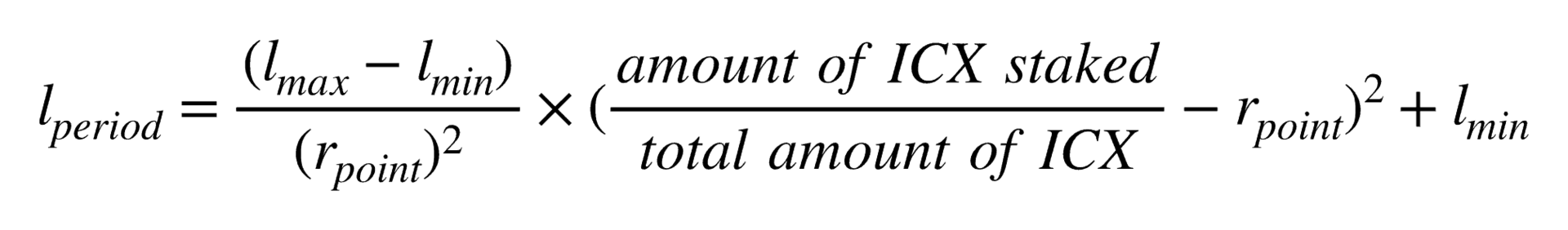

The length of the un-staking period is determined by the “percentage of network staked,” which is the amount of staked ICX divided by the total supply of ICX. Furthermore, the un-staking period ranges from 5-20 days depending on the percentage of network staked, and the un-staking period decreases as the percentage of network staked increases. Lastly, once the percentage of network staked reaches 70%, the un-staking period is fixed at five days. The un-staking period can be calculated with the equation below.

At first, this equation may look intimidating, but it’s actually quite simple when you understand what the variables are.

- lperiod - the length of the un-staking period

- lmax - the maximum number of days (20) of the un-staking period

- lmin - the minimum number of days (5) of the un-staking period

- rpoint - the percentage of staked where rewards become fixed (70%)

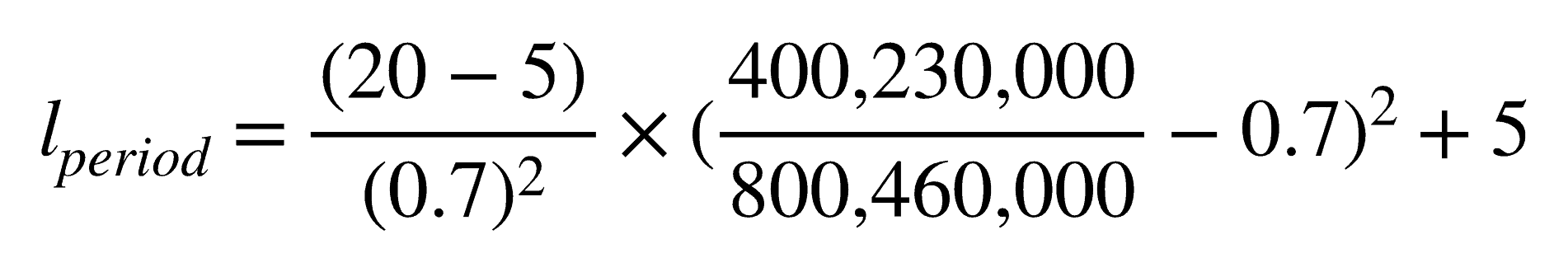

Here’s a sample calculation with 400,230,000 ICX staked out of a total supply of 800,460,000 ICX (50% staked). In this scenario, the un-staking period (lperiod) would be approximately 6.22 days.

One of the biggest misconceptions when it comes to ICON’s un-staking period is that it refers to the amount of time before ICONists can claim rewards – this is not the case. In ICON’s staking model, ICONists accumulate I-Score, a network metric that is used to quantify an entity’s contribution. I-Score is calculated and distributed every block (2 seconds), and ICONists can convert I-Score to ICX at anytime at a ratio of 1,000 I-Score to 1 ICX. The actual conversion process involves extinguishing I-Score, and claiming the equivalent amount of ICX from the public treasury. In some ways, ICX and I-Score resembles a two-token staking model like NEO and GAS. There are, of course, major differences – I-Score is a unit of value that measures contribution, and not a token that can be traded on secondary markets. However, the main point is that I-Score functions as a virtual secondary token that is independent of ICON’s un-staking period. In short, the un-staking period is the number of days that your initial ICX stake is locked up, and it has nothing to do with claiming ICX rewards by converting accumulated I-Score to ICX, which can be done at anyti

Why is the Un-Staking Period Necessary?

ICON’s DPoC (delegated proof of contribution) is a variation of DPOS (delegated proof of stake). In this consensus model, staking ICX through delegation to representatives, DApps (decentralized applications), and EEPs (ecosystem expansion projects) secures the network. In order for a network to be functional and appealing over the long term, it needs to be secure – this is why staking is a crucial component of ICON’s potential success. ICON’s un-staking period exists because the network craves stability and security. Imagine a scenario where you’re extremely low on money, and you don’t know when your next paycheck is coming. A situation like this creates “uncertainty” in your life, and the presence of this uncertainty influences your decisions.

For example, you may choose to limit yourself to two meals a day instead of three. If the amount of uncertainty increases, you may choose to cut down even more to one meal a day. If things get really desperate, you may end up resorting to unpredictable behavior to support yourself. The same concept, on a general level, applies to the ICON network as well. The ICON network exists to be used, and in order for it to be used, it needs to be appealing to all involved entities. Availability of high quality documentation and SDKs are appealing to developers, block rewards are appealing for node operators, and a variety of token standards are appealing to businesses looking to tokenize assets. All of these things are important, but at its core, security is what makes a network appealing. If the ICON network is not secure and stable, no one other than speculators will want to touch it.

So, how does the ICON network enforce stability? Now that we’ve established that staked ICX is essentially the lifeblood of the protocol, the most obvious way to keep the network in a healthy and functional state is to enforce an un-staking period. The network’s need for stability also explains why the length of the un-staking period is a function of the percentage of network staked. When the percentage of network staked is low, staked ICX is essentially a scarce resource. Thus, the network is incentivized to hold onto the staked ICX for a longer period of time as a safety buffer of sorts. Conversely, when the percentage of staked ICX is high, the network can thrive in a more economically stable and predictable environment where it doesn’t have to hold onto staked ICX for a long period of time.

Without an un-staking period, the stability of the network would be at the mercy of various behaviors derived from speculating on a hyper-volatile asset class. For example, if there was no un-staking period, it would be possible to respond somewhat immediately to changing market conditions (e.g. an emotionally-driven panic sell after a -5% move). The presence of an un-staking period effectively removes the potential for this kind of behavior, and it also assists in filtering out parties who are not actually committed to staking and securing the network. In exchange for taking on the economic and financial risk of locking up ICX for 5 to 20 days, ICONists who participate in staking are rewarded with I-Score, which can be converted to ICX at anytime.