ICONLOOP:

April 1st, Seoul — ICONLOOP has integrated its blockchain technology to SBI Savings Bank’s personal authentication service. ‘SBI Simple Authentication,’ the first blockchain-based authentication service launched in the Korean savings bank industry is now open to public.

SBI Savings Bank is a leading savings bank in South Korea with over $6.5 billion in assets. It is majority-owned by SBI Group, one of the largest financial services companies in Japan. ICONLOOP’s cooperation with SBI Savings Bank to build an authentication product is incredible news, but shouldn’t come as a surprise to followers of the ICON project

In a press release dated September 12, 2017, SBI Group announced a collaboration with DAYLI Intelligence to build financial service solutions using distributed ledger technology. Since DAYLI Intelligence is under the same corporate umbrella as ICONLOOP, it’s no surprise that loopchain, the engine that powers both ICONLOOP private chains and the ICON public chain, was the blockchain technology of choice for SBI Savings Bank’s consumer-facing personal authentication service.

Source: ICONLOOP

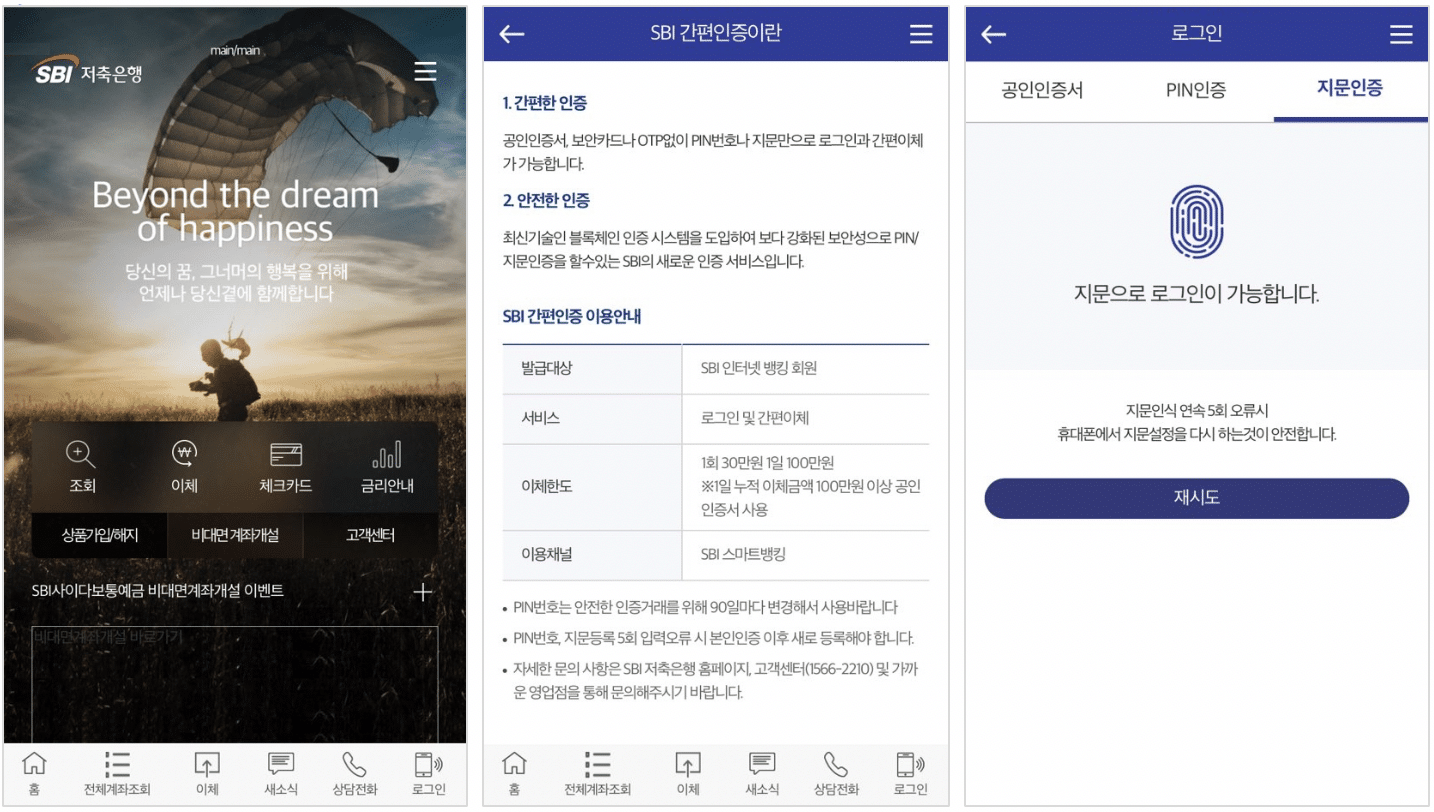

Together, ICONLOOP and SBI Savings Bank have developed SBI Simple Authentication, a service that is now available for user in the bank’s mobile app. The new system allows users to use a PIN number or fingerprint “without a public certificate, security card, or one-time password (OTP).” Instead of authenticating user identification information through a central certificate authority, SBI Simple Authentication “stores” PIN and fingerprint information through node consensus, and uses a smart contract developed with ICONLOOP’s SCORE to verify data integrity.

From a user experience perspective, SBI Simple Authentication is a giant leap in the right direction. Previously, certificate issuance in Korea was handled via centralized certificate authorities, and the process of authentication for using financial services was literally a blast from the past. In order to access basic financial services, including online shopping, residents of Korea were bound to an outdated certificate authentication system powered by an ActiveX plugin.

Never heard of ActiveX? That’s not surprising at all. ActiveX was a plugin standard developed by Microsoft to extend the functionality of Internet Explorer, a once-popular web browser that now only accounts for 5% of usage worldwide. So, where is ActiveX now? It’s unsupported by Microsoft’s own Edge browser – that’s all you need to know.

SBI Simple Authentication is a positive development for all parties involved. SBI will have “noteworthy cost savings,” while users will no longer have to fiddle with Internet Explorer and outdated ActiveX plugins. The latter point is very significant because it effectively reduces the level of friction in the financial transaction process. Imagine a world where you have to hunt down a computer with Internet Explorer installed every time you needed to make an online purchase or bank transfer. Now, imagine a world where you don’t have to do any of that. Which world would you rather live in?

ICONLOOP has been working with SBI Savings Bank since November of 2018 to certify electronic documents, as well as to provide blockchain-based authentication services. SBI Savings Bank employees are currently uploading file attachments from SBI Groupware boxes, such as draft documents and official notices, to a blockchain-based document certification system.

Timestamping is a legitimate use case of blockchain technology, which ICON has recently demonstrated in a collaboration with the Seoul Metropolitan Government on the public ICON chain. For now, SBI’s timestamping and document certification doesn’t appear to involve ICON’s public chain, though according to the press release, public chain use cases may arise in the future. I don’t view this as a negative for supporters of the public ICON chain, and I certainly don’t subscribe to the ideology that ICON is somehow insulated from ICONLOOP’s success and more importantly, business connections. ICONLOOP has a foot in the door with one of the largest financial services providers in the world. With this in mind, it only makes sense to push adoption of the public ICON chain, well, when it makes sense.