In ICON’s initial network design, public representatives (P-Reps) had the power to influence ICX reward rates. Recently, ICON Foundation decided to change the reward model to reduce the power of P-Reps. In the network’s current state, the ICX reward rate is a function of the percentage of network staked, and there are no other contributing factors. In this post, we’ll discuss how the ICX reward rate is calculated, along with the economic implications of a lowly staked network versus a highly staked one.

ICX Reward Rate

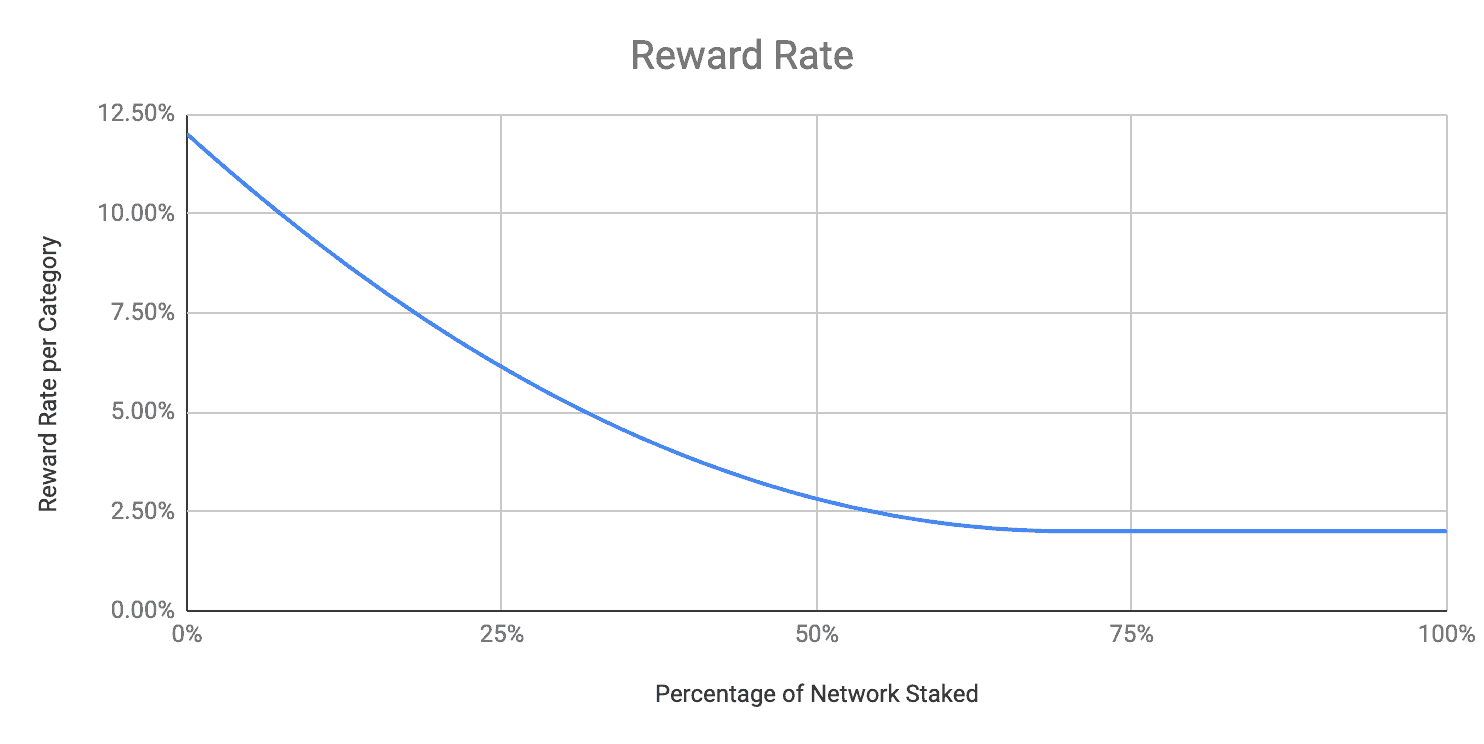

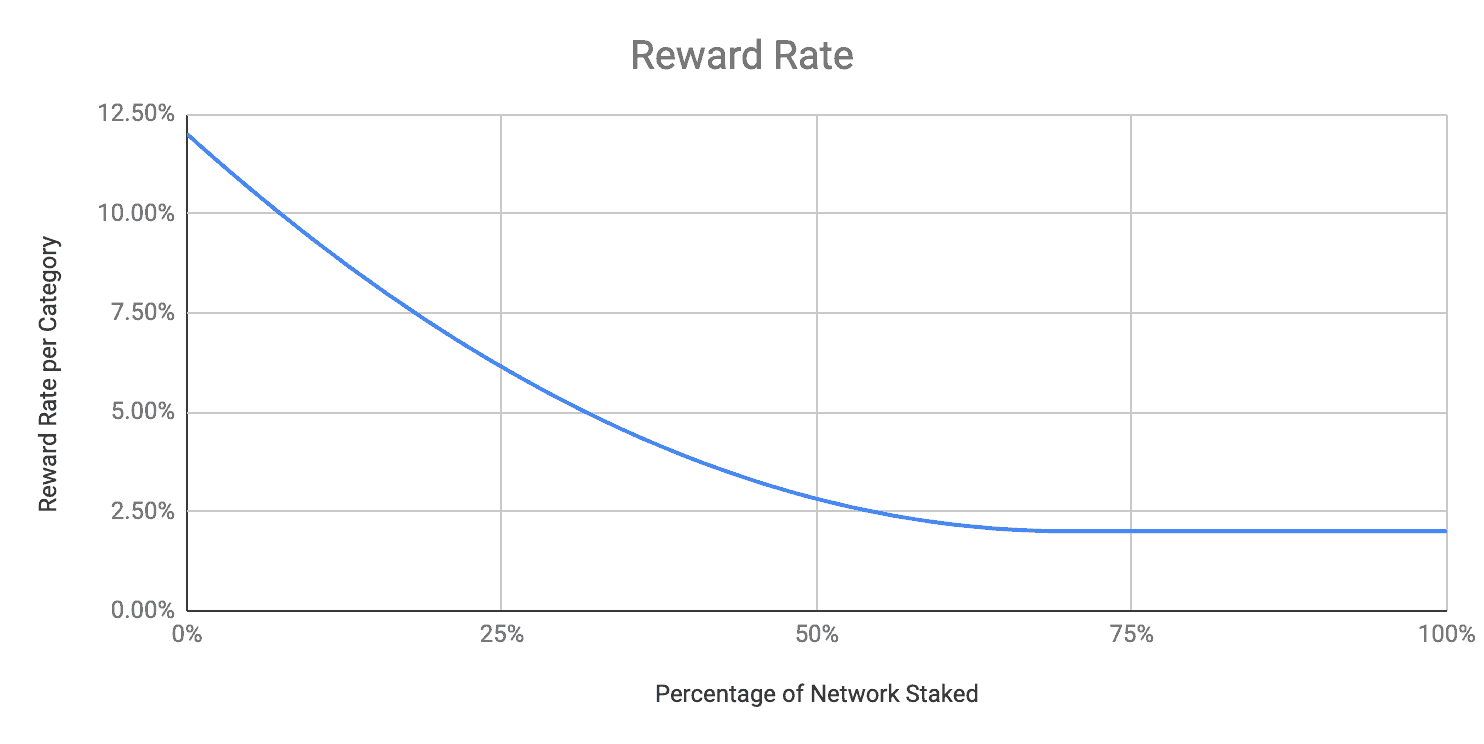

The chart below shows how the relationship between the percentage of network staked and ICX reward rate. Keep in mind this chart shows annualized rates per category of which there are three - Reps, EEPs, and DApps.

Source: ICON Foundation

Below are a few key observations of the ICX reward rate.

- As % of network staked increases, the reward rate decreases.

- As % of network staked decreases, the reward rate increases.

- The reward rate per category ranges between 2% and 12% per year. Staking to all three categories results in a rate that ranges between 6% and 36%.

- Once % of network staked crosses above the 70% mark, the reward rate becomes fixed at 2% per category.

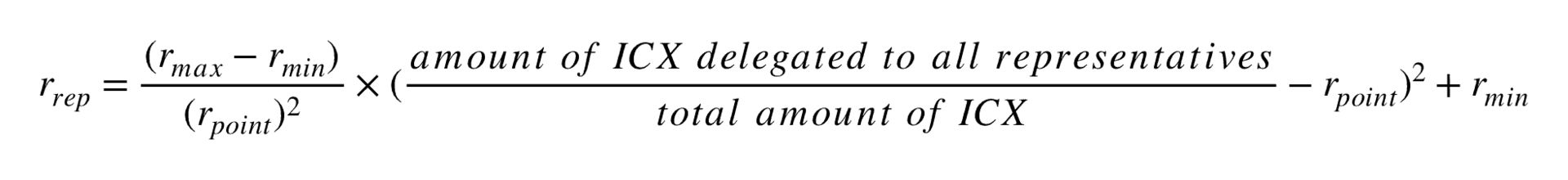

The following equation can be used to calculate the ICX reward rate.

Now, let’s solve the equation with the following two assumptions.

- The total amount of ICX is 800,460,000.

- The amount of ICX delegated to representatives is 400,320,000.

Solving the equation above, which assumes 50% of the network is staked, yields an rrep figure of ~2.82%. Thus, with 50% of the network staked, ICONists can expect a reward rate of ~8.46% per year.

ICX Un-Staking Period

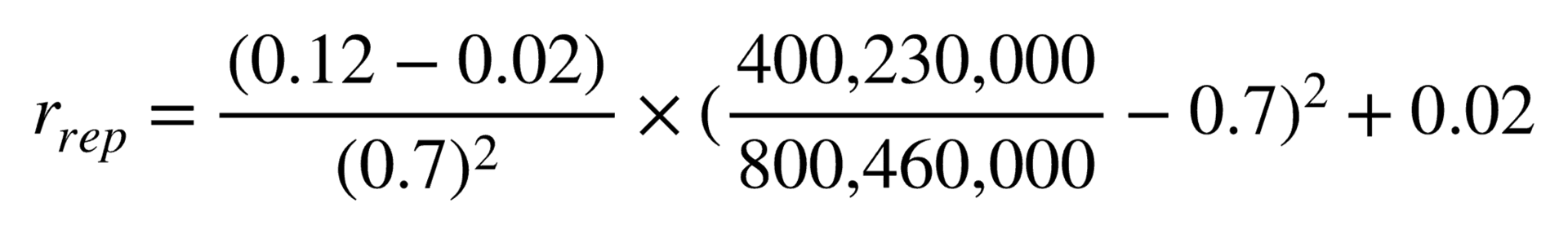

ICON also has an “un-staking” or lockup period that is also derived from the percentage of network staked. The un-staking period refers to the minimum number of days that must pass before you can unstake ICX. Keep in mind the un-staking period does not refer to the amount of time that must pass before collecting rewards – that can be done at anytime by converting I-Score (the unit of value of staking rewards*)* into ICX. The un-staking period only refers to the amount of time that ICX is locked up in an immobile state. Here is a chart that shows the correlation between the percentage of network staked and the number of days of the un-staking period.

Source: ICON Foundation

Below are a few key observations of the ICX un-staking period.

- As % of network staked increases, the un-staking period decreases.

- As % of network staked decreases, the un-staking period increases.

- The un-staking period ranges between 5 and 20 days.

- Once % of network staked crosses above the 70% mark, the un-staking period becomes fixed at 5 days.

If you’re interested in learning more about ICON’s un-staking period, be sure to check out this post.

High Reward Rate vs. Low Reward Rate

With the above information in mind, it’s easy to come to the conclusion that a lower network staked percentage, and thus higher reward rate, is beneficial to ICONists. I think this perspective is short-sighted, and a lower reward rate is more favorable to investors in the long run.

Implications of a High Reward Rate

A high ICX reward rate indicates a low staking percentage. As an investor, it’s essential to focus on the economic implications of the reward rate, rather than the actual reward rate percentage. An annualized reward rate of 28% looks great on paper, but in context of the ICON network, it implies an extreme lack of network stability and public interest in staking – two factors that could potentially cause the network to become worthless over the long term. Let’s break it down a little further with the following assumptions.

- The network is 10% staked.

- The ICX reward rate is ~28% per year.

- The un-staking period is ~16 days.

ICON is a delegated proof of contribution (DPoC) network. Without ICONists staking or delegating ICX to P-Reps, there is little incentive for P-Reps to invest significant time and money to build a secure and highly available node infrastructure. This in turn lowers the overall transaction validating capability and quality of the network, and reduces the chance of meaningful adoption because no serious party would voluntarily use an insecure and unreliable network to transact real value. As you can see, over the long term, a low network staked percentage would result in a negative feedback loop that would drive the ICON network straight into the ground. The potentiality for the above scenario is precisely why the ICX reward rate increases as the network staked percentage decreases.

A high reward rate should not be thought of as a source for passive income and incredible ROI. Instead, a high reward rate is the ICON network’s incentivization tool to encourage ICONists who are willing to risk staking ICX tokens to a network that hasn’t fully stabilized. The high reward rate is a risk premium, and this factor is reflected in the un-staking period as well. Imagine waking up one day to find yourself in the middle of the zombie apocalypse. You spend the next few days holed up at home trying to refresh Blockfolio, but at some point you realize Internet connectivity is a thing of the past. After spending a few hours in denial, you finally muster up the courage to go outside to find food and water.

Carl and Rick looking for their ICX bag.

After hitting up the local 7 Eleven, you manage to score enough water, instant noodles, Oreos, and vodka to last 5-10 days depending on how you ration. Since you are uncertain about when you’ll be able to stock more food and water, you are incentivized to make the supplies in hand last as long as possible while maintaining an adequate level of energy to fight zombies. The doomsday scenario highlighted above has more in common with ICON’s un-staking period than you may realize. When the network staked percentage is low, the ICON network is effectively low on supplies. This is why the un-staking period is much higher when there is a low staking percentage. The ICON network doesn’t know when it’ll receive more ICX in the form of staked tokens from ICONists, so it is incentivized to be “greedy” and hold on to the tokens it already has for as long as possible within reason. Summarizing the above points, we can deduce that a high ICX reward rate over the long term has the following implications on the ICON network.

- There is little interest in ICON and staking ICX.

- There is little incentive to keep the network secure and stable.

- The network’s transaction processing capability is compromised.

- The future of the ICON network is uncertain.

Implications of a Low Reward Rate

Now, that we’ve covered the implications of a high ICX reward rate, let’s discuss what a low reward rate reveals about the ICON network and why it is favorable over the long term. A low reward rate indicates a highly staked network, which is only possible if the overwhelming majority of network participants believe in the future of the network enough to stake ICX. Let’s break it down a little further with the following assumptions.

- The network is 70% staked.

- The ICX reward rate is 6% per year.

- The un-staking period is 5 days.

On paper, a 6% reward rate doesn’t look as good as a 28% reward rate. However, in the context of the ICON network, a 6% reward rate implies a high level of network stability and public interest in staking ICX – two factors that must be fulfilled for the ICON network to increase in both practical and market value over the long term. As discussed earlier, ICON is a DPoC network. Thus, a high network staked percentage indicates ICONists are actively contributing by delegating ICX to P-Reps, DApps, and EEPs. As a result, the delegated parties are incentivized to act in the best interest of the network and the delegating ICONists. For P-Reps, that would entail setting up a secure and reliable node infrastructure to ensure transactions can be processed in a stable and predictable and manner. Over the long term, a highly staked network would result in a positive feedback loop – ICONists participate by staking, staking creates a secure network, external chains and communities connect to ICON due to the network stability, new network participants acquire ICX to stake, etc.

Looking back at the reward rate curve shared above, you can see 70% network staked is where the ICX reward rate and un-staking period flatlines – 2% reward rate per category and a 5 day un-staking period. In my opinion, 70% network staked is the “stability threshold” for the ICON network – at least in the current implementation of IISS. 70% appears to be the magic number where the ICON network is “confident” that it will have enough delegated ICX to perform network functions in a secure, safe, and predictable manner. As a result, the network can offer a constant reward with a constant un-staking period of 5 days – a clear sign of network stability.

The zombie apocalypse scenario applies here as well. Earlier, we discussed how you would be incentivized to ration food and water for as long as possible during times of uncertainty. The story would be different if you were able to locate a warehouse full of supplies. Instead of rationing supplies, you would be incentivized to consume food and water at a more normal pace to maintain good nutrition. The same concept applies to ICON’s un-staking period. When there is a low supply of delegated ICX, the network is greedy and locks it up for 20 days. Conversely, when there is a stable supply of delegated ICX, the network is less conservative and only locks it up for 5 days. While the reward rate of a highly staked network (70% staked, 6% reward) is lower than that of lowly staked one (10% staked, 28% reward), the market price of ICX should be taken into account as well. In a highly staked network, there are several factors that could contribute to a higher ICX price.

- A highly staked network removes a significant amount of ICX from the circulating supply, which typically translates into a higher token price on exchanges and other secondary markets.

- A highly staked network is a sign of network stability and positive outlook. If network participants are willing to lock up value for extended amounts of time, it means they are confident in the future success of the network.

- A highly staked network incentivizes both delegating and delegated participants to act in the best interest of the network – run secure nodes, spreading awareness, building DApps, creating content, etc.

All of the above can be summarized with one idea - in the context of the ICON network, a lower reward rate is more favorable for long term investors because it indicates a high level of confidence in the ICON network, which is essential for mainstream adoption and real-world usage. Don’t speculate on the short term, invest in the long term.