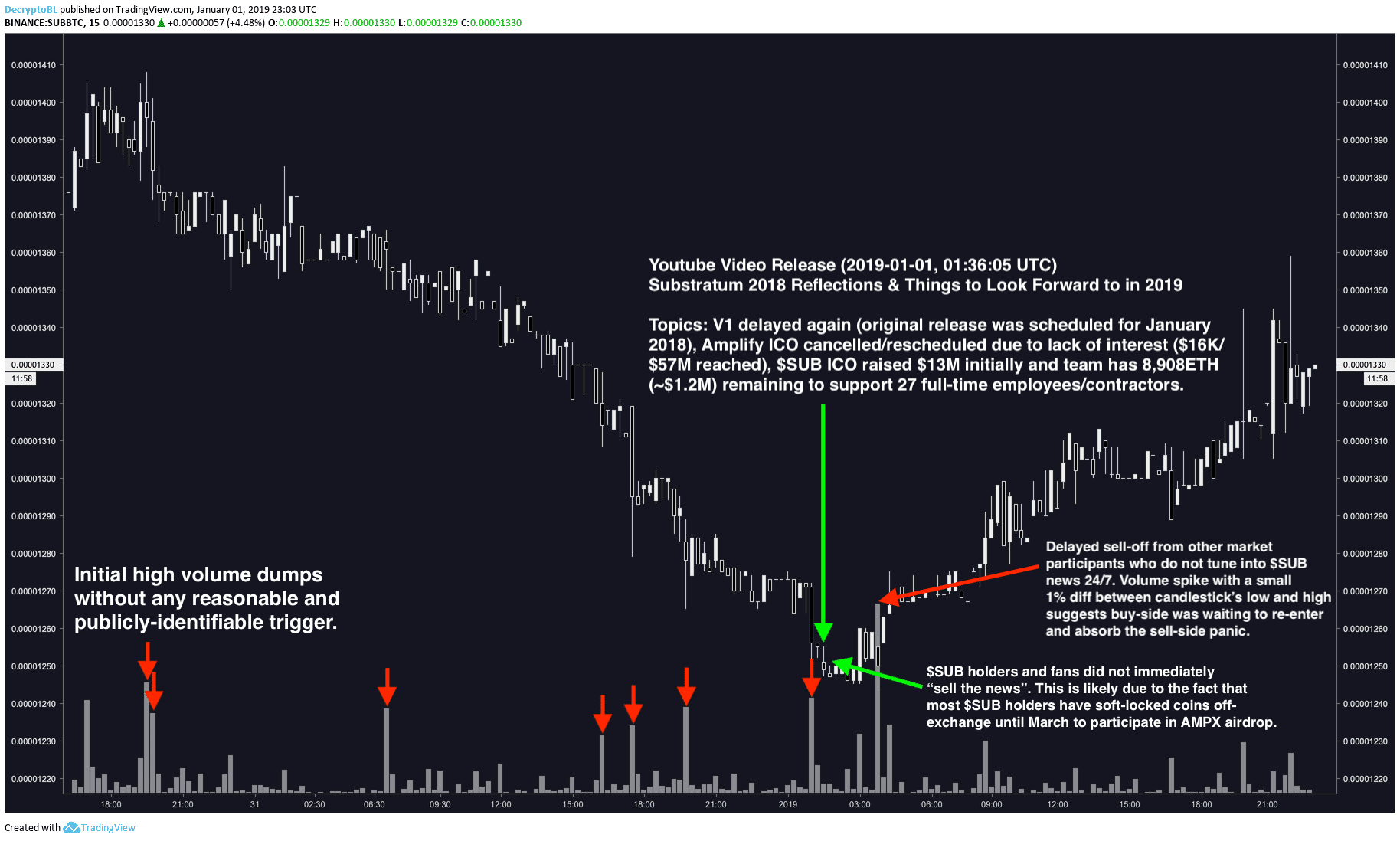

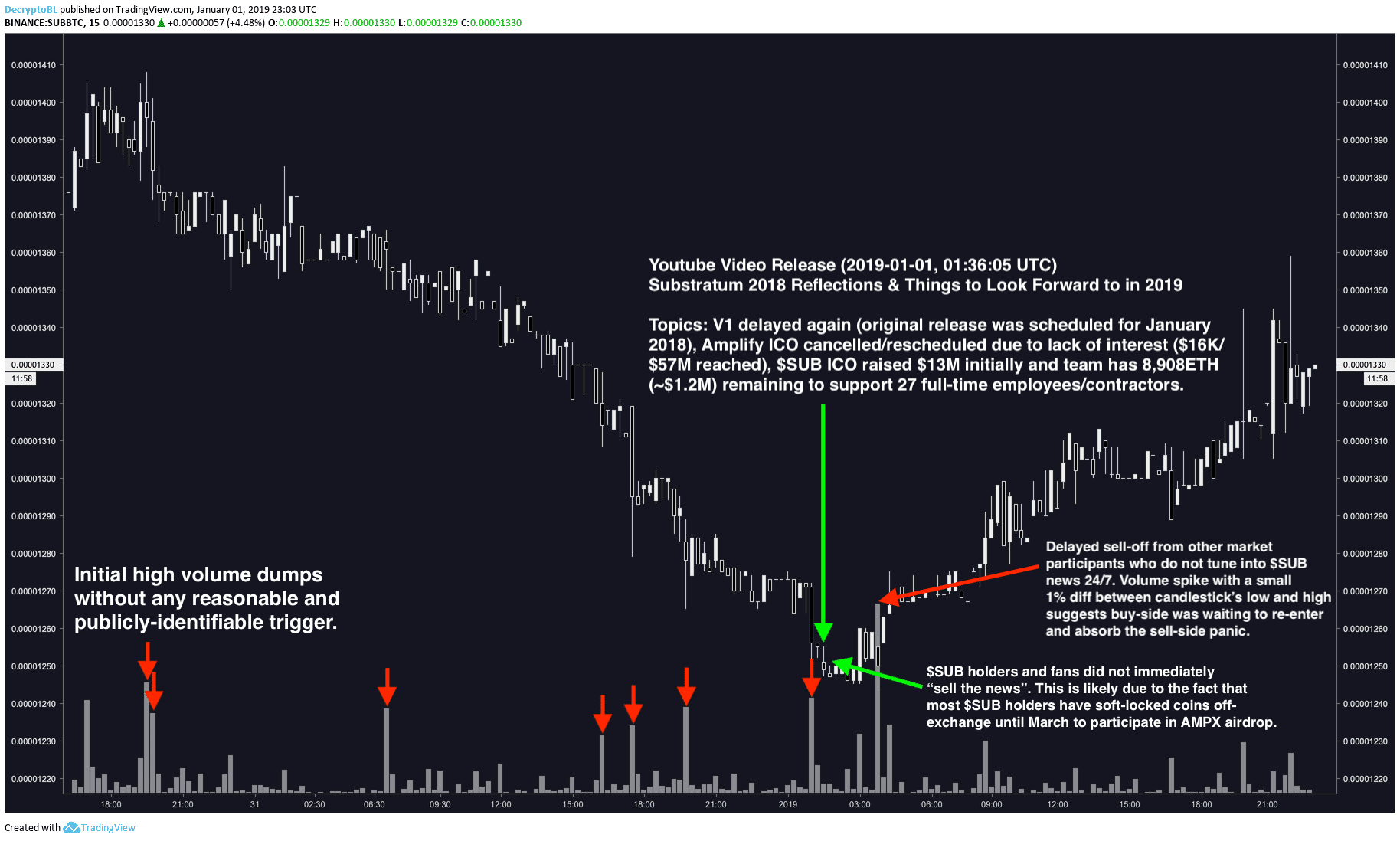

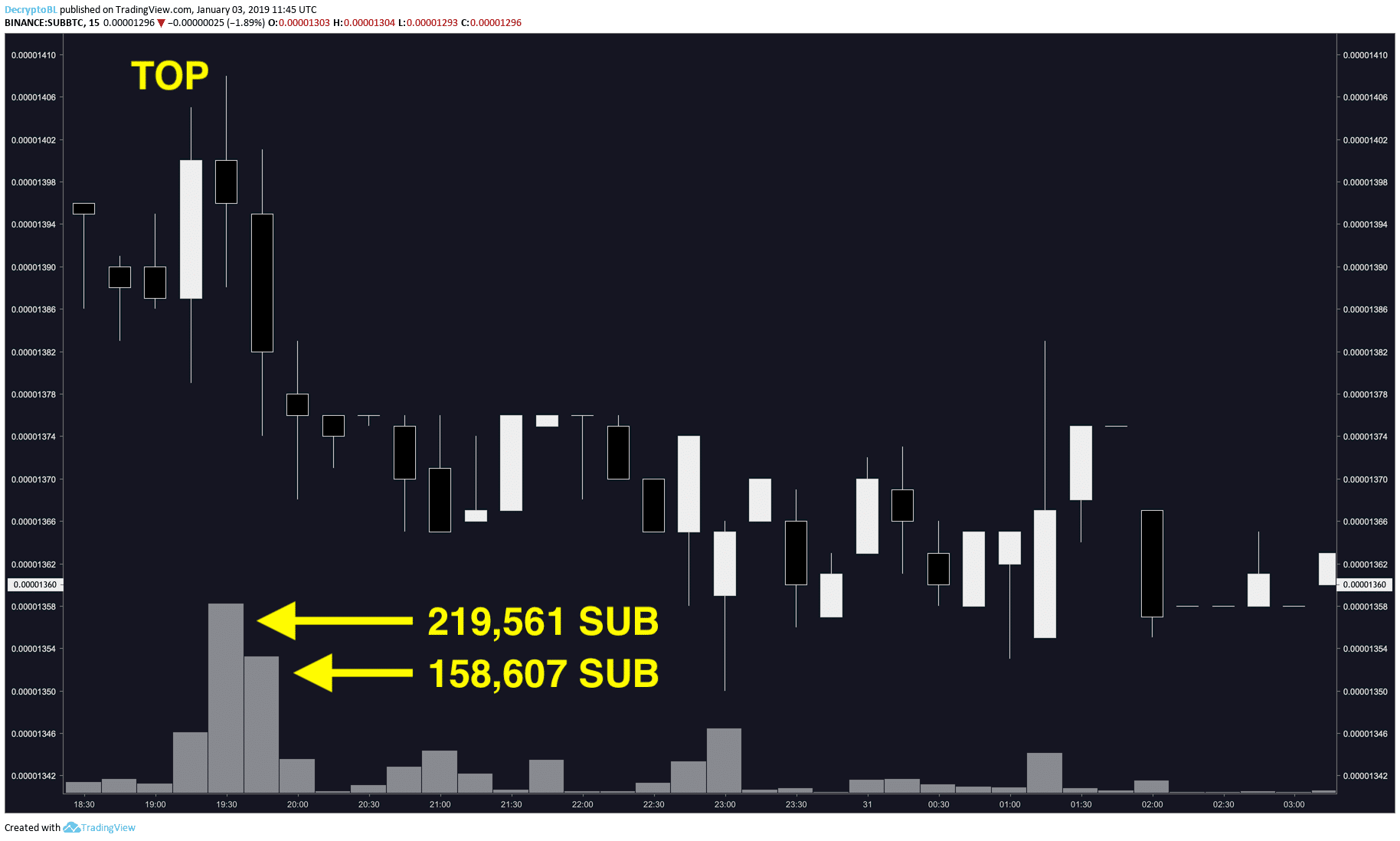

Earlier today, I came across this Reddit thread about the price of SUB pumping 15% in the days leading up to the scheduled EOY2018 release of SubstratumNode V1. I did not find this initial price increase to be suspicious because “buy the rumor, sell the news” is a very well documented behavior in capital markets. What I did find suspicious was the subsequent downtrend that started around 7 PM (UTC) on December 30, 2018. Here’s a chart showing the price action of SUB/BTC on Binance along with a few observations.

On January 1, 2019 at 1:36 AM (UTC), Substratum CEO Justin Tabb released a video titled “Substratum 2018 Reflections & Things to Look Forward to in 2019”. The 24-minute video addressed a number of things including Substratum’s success in routing traffic through censorship-heavy regions, a further delay of SubstratumNode V1, the temporary cancellation of the Amplify Exchange ICO, and Substratum’s current financial status. The Substratum community’s response to Justin’s video was overwhelmingly positive for the most part, but I firmly believe it’s much too early to celebrate.

Successful Traffic Routing Tests ?

Substratum did technically route traffic through China, Iran, and Russia. I’ve used the current CLI-only implementation of SubstratumNode myself to set up a small globally-distributed network for personal testing. It does work, but only in the sense that traffic can be routed through the nodes. However, until encryption and masquerading are properly implemented, there is no point in talking about penetrating the cyber-security infrastructure of nation states around the world. Again, this development looks great on paper. In technical terms, this development is neutral at best until the node software has gone through a proper third-party security audit — something that the team has expressed interest in doing following the V1 release.

A Further Delay of SubstratumNode V1 ?

SubstratumNode V1 was originally scheduled for release in January 2018 (one year ago). As time passed, the team decided to include more features, which resulted in a longer development time. This is completely understandable. Over the course of 2018, Justin Tabb made several announcements promising a full production release by EOY2018 — the most recent instance occurred during an interview with Datadash from December 7, 2018. Tabb’s constant hyping throughout 2018 set false expectations, and has once again resulted in a terrible PR disaster for Substratum.

Amplify Exchange ICO is Canceled ?

Substratum’s second ICO for its Amplify Exchange was originally scheduled to run until January 15, 2019. Unfortunately, the AMPX ICO with a hard cap of $57 million only attracted ~$16,000 (subtracting the $5 million in private funding means Substratum was only able to reach a mere 0.3% of their funding target). As a result, Justin Tabb has decided to temporarily cancel the ICO and refund ETH contributions, while letting said investors keep their AMPX tokens. Later on, Tabb states that AMPX tokens will be available for sale after the MVP launch of the Amplify Exchange platform in the first half of 2019.

For me, the cancellation of the AMPX ICO is a huge red flag. The AMPX ICO’s hard cap was a mind-boggling $57 million. For reference, Substratum’s original ICO raised ~$13 million. With only $16,000 in contributions this time around, it’s clear that the market doesn’t give a s*** about Substratum as a company. Furthermore, I’d be interested to know the impact of a failed ICO on Amplify’s business plan and how the team plans to scale down operations while remaining competitive with $52 million less capital to work with.

Substratum’s Financial Outlook ?

Finally, Justin Tabb touched on Substratum’s financial outlook going into 2019. During its ICO, Substratum raised a total of $13.8 million. The team accepted a variety of currencies including BTC, ETH, and XRP. According to Tabb, Substratum was able to raise 17,787 ETH, though I’m not sure if this number actually matters because the resulting USD amount was eventually distilled and hedged into four assets — BTC, ETH, USDT, and USD.

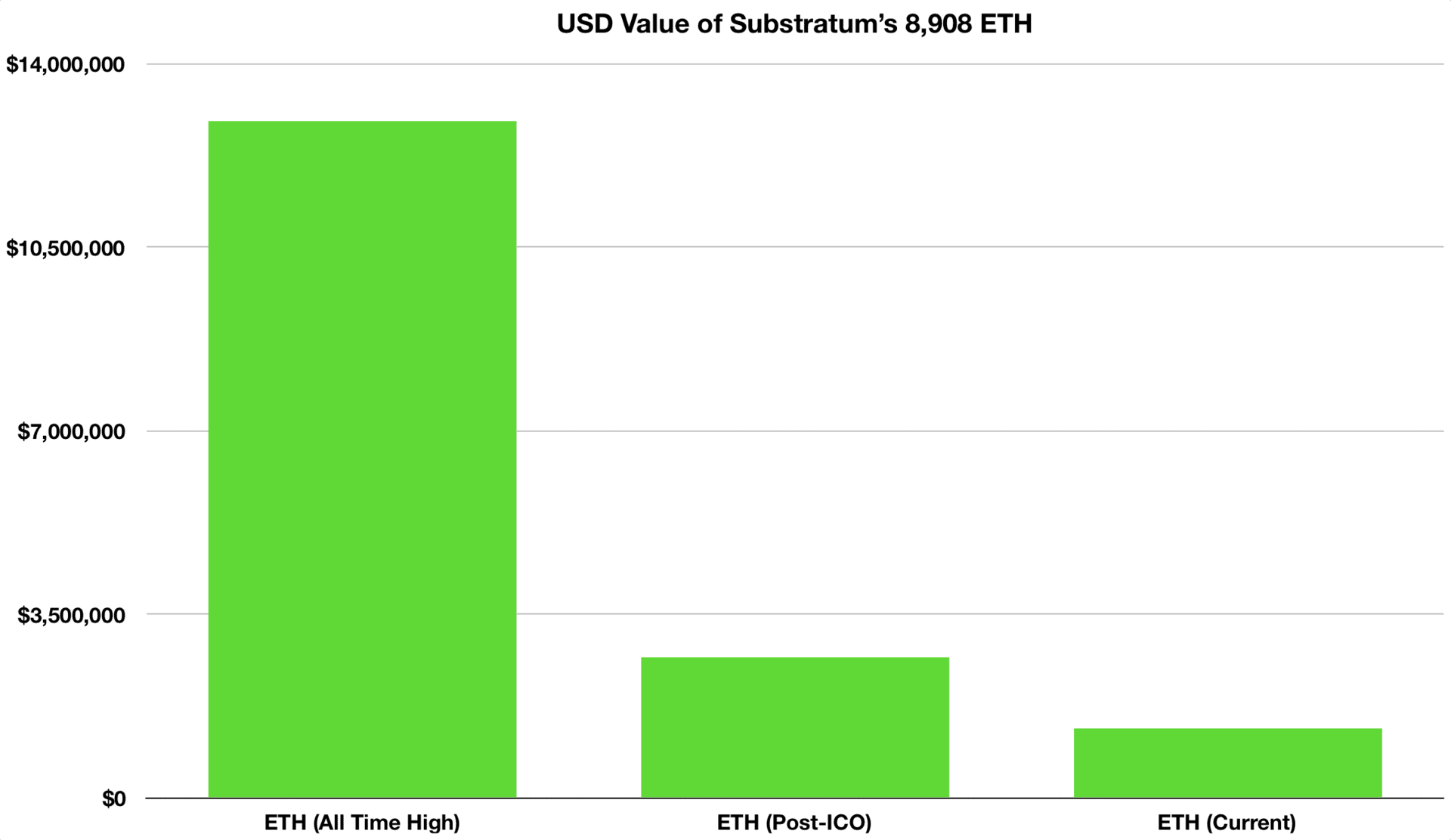

For the purposes of this post, let’s assume the 17,787 ETH is relevant. In order to justify Substratum’s positive financial status, Tabb constantly reminds us that it has “over half” of its ETH remaining. That’s true, Substratum does indeed have 8,908 ETH remaining. However, Tabb neglects to mention that 8,908 ETH is only worth ~$1.1 million at current market price. After factoring in slippage, trading fees, withdrawal fees, and potential taxes, Substratum’s 8,908 ETH is worth much less than $1.1 million.

It’s possible that Substratum still has capital in the form of BTC, USD, and USDT, but there’s no point in speculating about that. What we do know is that Substratum has constantly been transparent with the quantity and location of its ETH holdings, but has never revealed the same details for holdings in other assets. Furthermore, Tabb’s recent mentions about Substratum’s financial position have all revolved around ETH as the base currency (e.g. selling a small portion of ETH at $1,200, trading the ETH/USDT pair with the help of Bollinger Bands, and justifying the company’s positive financial health by stating it still has over 50% of its raised ETH).

When it comes to crypto, I’ve observed a psychological phenomenon that manifests itself in the form of falsely-backed value biases that are derived from mental fragmentation and dissonance. Tabb often exhibits this effect while talking about Substratum’s financial status. For example, he rarely talks about the firm’s holdings in USD terms despite the fact that the majority of real-world business obligations and debts are settled in USD. Furthermore, 2017’s bull market has left a lingering psychological effect that makes 8,908 ETH seem like a large sum of money — at ETH’s ATH, 8,908 ETH was worth ~$12 million. Today, it’s worth 90% less, but many people still haven’t fully accepted this.

Let’s run the numbers. Justin Tabb revealed Substratum currently has 8,908 ETH and 27 full-time employees. Once again, I am not considering other sources of capital that I am not aware of. Today, the price of ETH is $150, so 8,908 ETH is worth $1,336,200. With a very conservative 5% reduction to account for slippage, fees, and taxes, 8,908 ETH is equal to $1,269,390. Divided between 27 team members, $1,269,390 yields $47,014 per person. According to ZipRecruiter, the average yearly salary for a Rust developer is $94,715, which is approximately double the amount that Substratum has allocated to each team member for one year. Obviously Substratum’s 27 team members are not all Rust developers, but the point still holds. Furthermore, this calculation does not account for any other typical business costs.

Do you see where this is going? Justin Tabb saying Substratum has over 50% of its ICO ETH holdings left is meaningless. Real-world business is conducted in USD, and 8,908 ETH is equal to 10% of the company’s ICO funding. This is further compounded by the fact that Substratum has no viable business model that will generate cash flow in the near future. This financial situation doesn’t look good at all. In fact, things look very grim.

Back to the Chart

With the above analysis in mind, it’s easy to see how Justin Tabb skirted around video’s potential negativity by layering a series of positive diversions on the surface. However, upon further observation and thought, it’s very obvious that this video is negative in nature. With this new perspective, take a look at the above SUB/BTC chart once again.

Here’s my interpretation. The biggest red flag is that Justin’s video coincides precisely with the bottom of this particular declining market structure. Starting on December 30, 2018, a series of high volume spikes supported a clear downtrend. At the time of the first two volume spikes, there were no publicly disclosed panic triggers to act as catalysts for a high-volume sell-off. According to Substratum’s own community, everything was going as planned and there were even some discussions about Substratum waiting until the last minute to deliver V1 of SubstratumNode.

The 30-45 minutes after Justin’s video release was met with very low volatility, which suggests that the people who pay attention so SUB 24/7 had no interest in selling or were incentivized not to sell. In this case, many SUB holders currently have their tokens soft-locked in wallets until March in anticipation of the AMPX airdrop. On a slightly unrelated note, I find it hilarious that SUB holders have chosen to trade the opportunity cost of not selling SUB at overbought levels in exchange for AMPX tokens which are now being given away for free due to the cancellation of Amplify Exchange’s ICO — trading potential value for something that’s being given away for free.

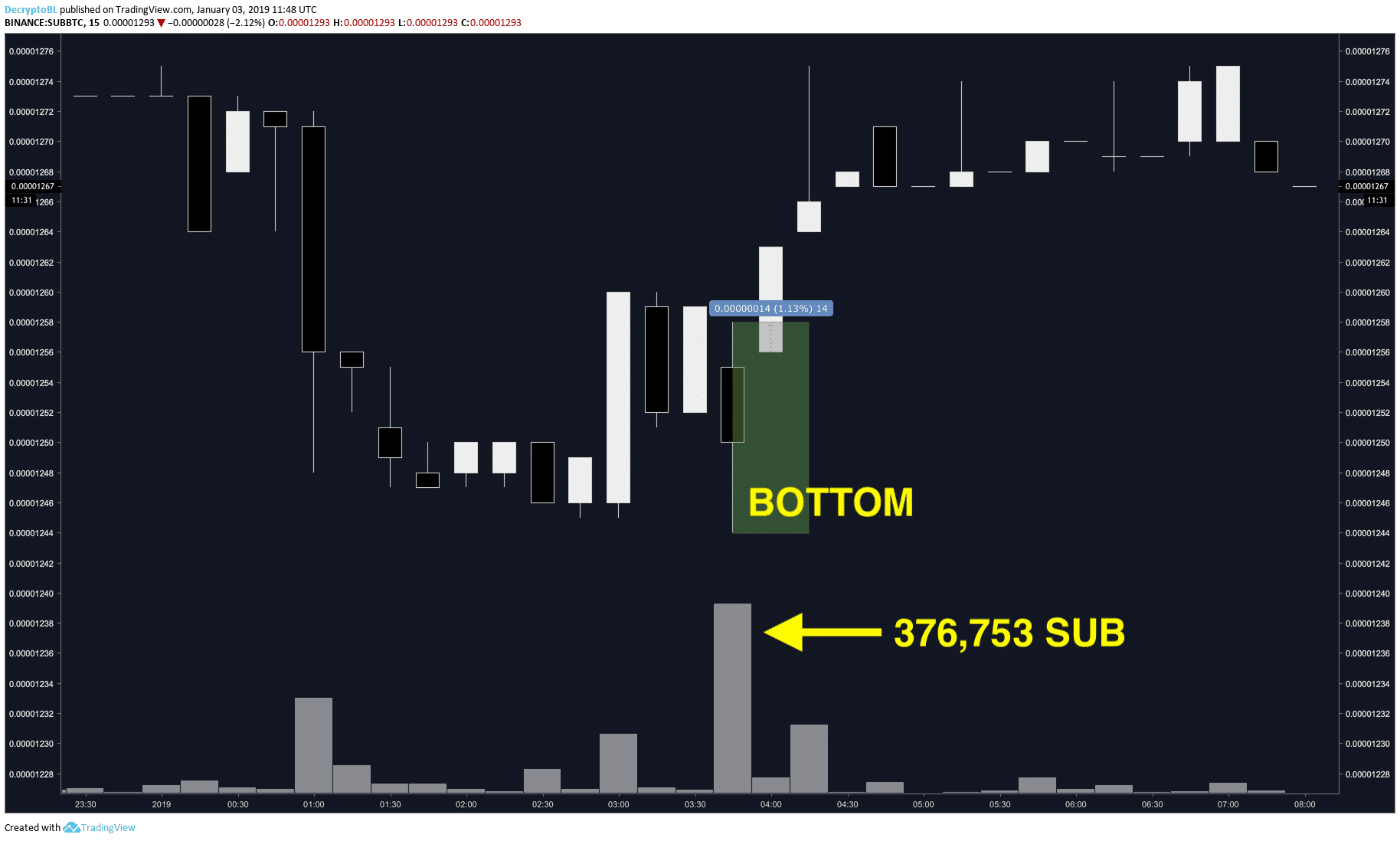

An extremely high volume spike occurred around 3:45 PM (UTC). The interesting thing to note is the ~1.13% difference between this candle’s low and high. Typically, high volume candles exhibit a larger degree of volatility, and this is especially true on a low-volume coin like SUB. For example, a 15m candle on December 29, 2018 at 8:30PM (UTC) caused a 4.5% spike with much lower volume. The reason why the volume spike in question did not cause a huge dump is because someone was waiting with large buy orders in place to absorb the panic-induced liquidity.

Furthermore, the volume stats of the two 15m candles at the local top prior to the downtrend reveals that 378,168 SUB (219,561 + 158,607) were traded. Coincidentally, the volume stats for the 15m candle where someone absorbed all the panic sells from market participants external to Substratum’s community indicates 376,753 SUB were traded. The unit difference, which can be interpreted as noise, between these two high volume moves is 1,415 SUB (~$65). To summarize, someone was able to sell 378,168 SUB at the top, and someone was waiting to buy 376,753 SUB at the bottom. On a low-volume coin like SUB, the lack of market surprise to such a high-volume move, as indicated by a candle with 1.13% volatility, is suspicious and is indicative of someone having premeditated intent to buy back an equal amount of SUB at a lower price and pocketing the difference in BTC.

Now, ask yourself these questions.

- Who can dump over 360,000 SUB?

- Who is able to time a buyback precisely after the release of a video containing bad news?

- Who satisfies both of these conditions?

My answers, with no definitive accusations.

- Anyone with over 360,000 SUB.

- Anyone with prior knowledge of the contents and the exact release date and time of Justin Tabb’s “Substratum 2018 Reflections & Things to Look Forward to in 2019” video.

- Very few people.

On a slightly related note, this is not the first time that suspicious trading activity involving SUB has happened. A similar situation occurred during Substratum’s false Coinbase listing last year.