Substratum is currently trying to build a decentralized Internet, a payments processing platform, and a decentralized exchange. I think these goals are overly ambitious, but that’s just my opinion. Let’s get into it.

Disclaimer: Stop reading here if you’re a SUB bagholder. If you choose to continue reading, I am not responsible for hospitalization costs due to high blood pressure. You’ve been warned.

Product 1 — Node & Host

SubstratumNode and SubstratumHost make up the core of the Substratum ecosystem. SubstratumNode is an anonymous data routing protocol built to bypass net neutrality and Internet censorship. SubstratumHost is a web hosting service built on top of the network and allows anyone to contribute computing resources to an incentivized and distributed web hosting service from the comfort of their own home.

To my knowledge, no other blockchain project has made significant progress in this niche and Substratum is the clear market leader. I also believe bypassing censorship by incentivizing users to contribute to a distributed relay network governed by smart contracts is a viable use case for blockchain. In other words, Substratum’s Product 1 isn’t creating a problem that needs to be solved. The problem already exists.

SubstratumNode is in competition with traditional centralized VPNs, an industry worth over $15 billion. SubstratumHost is looking to decentralize the web hosting industry, an industry estimated to be worth over $150 billion by 2022. Together, the centralized variations of Substratum’s core product will be worth over $165 billion in the next five years. This is a huge market, and Substratum is in a prime position to become the industry leader on the decentralized side, so it really makes you wonder why the team is actively distracting themselves with Product 2 and Product 3.

Product 2 — CryptoPay

CryptoPay is a payment processing layer that will enable people to pay for goods and services with crypto. Unlike Product 1 which has an actual use case for blockchain, there is no evidence that consumer-facing blockchain and crypto-based payments have any significant benefit for modern society. I see a need for institutional-level blockchain settlement platforms like RippleNet and perhaps fiat-pegged cryptocurrencies on the government level, but I just don’t see a world where people need to use crypto for day to day spending unless they live in a developing country with an extremely volatile fiat currency.

I currently live in Tokyo where most of my daily spending is done via a reloadable NFC SUICA card on my iPhone. SUICA can be used at convenience stores, restaurants, subway stations, and more. Hong Kong has a similar contactless payment method called Octopus, and many other countries have similar frictionless solutions. The keyword is “frictionless,” and that’s exactly what crypto is not. Why pay fees to acquire a hyper-volatile crypto asset to pay for a good or service? I get that it satisfies the anarchist and “f*** the government” urges of a small population of wannabe hackers in first-world countries, but to the average person, buying crypto to purchase something else is just stupid. While I think mainstream consumer-facing crypto adoption is still very far off, I can see why some businesses may want to accept crypto as a novelty hedge and PR move. Overstock, who partnered with ShapeShift to accept over 60 different cryptocurrencies, is a good example of this.

In general, I don’t think CryptoPay is inherently a bad idea, but I do think it’s foolish of Substratum to think they’ll be able to make any significant progress in the payments arena. On the centralized side, they’re going up against industry giants like PayPal, Amazon, and Square. On the crypto side, they have to somehow compete with Coinbase and ShapeShift. Wait, let me rephrase that. On the crypto side, they have to somehow compete with “the world’s most legitimate and regulatory-compliant multinational blockchain financial services company with hundreds of employees dedicated to dominating the future of value transfer with crypto” and ShapeShift. I’m all for innovation, but I really think it’s too late to beat Coinbase when it comes to payment services.

Product 3 — Amplify DEX

A few days ago, Substratum announced the Amplify DEX and AMPX ICO at their monthly SUBLOCC meetup. Speculations included never before seen alien technology, a use case for the SUB token that would propel it to #1 in market cap rankings, and perhaps a solution for global peace.

Drum roll, please.

Product 3 is a decentralized exchange that won’t use the SUB token as a liquidity underpinning. Yeah, you heard that right. Substratum is releasing a DEX that doesn’t use SUB as a liquidity source. Instead, the team will be conducting a public ICO so unsuspecting followers can trade hard-earned BTC and ETH for worthless AMPX tokens. Again, you heard that right. Substratum will not be accepting SUB for this ICO. This should tell you something about their internal perspective on the future value of SUB, and it really made me wonder about what’s really going on behind the scenes. Be aware the following is complete speculation, but it makes sense to me.

First, let’s talk about the public reaction to Product 3. There are two camps. The people grounded in reality see Amplify for what it is — a DEX that is at least a year too late, while the permanent residents of Substratumville have somehow convinced themselves that entering the most competitive space in crypto is a terrific idea and totally not suspicious.

How many decentralized exchanges are there in the space? Off the top of my head, I can think of WAVES, BitShares, Radar Relay, Bisq, and Stellar DEX. World-class projects like ICON and OmiseGO with their extensive banking and business connections are also working on their own decentralized exchanges. Lastly, several centralized crypto exchanges with established userbases are working on decentralized platforms of their own, with the most notable example being Binance, the world’s number one exchange with literally hundreds of millions of dollars at their disposal and hundreds of task-specific employees. You can not expect me to believe a small company that’s attempting to build a decentralized Internet and innovate in the payments industry will have the time, money, and focus to develop a competitive DEX.

So, why build a DEX?

The simple answer is because there is a high chance of failure and no one will question you if it doesn’t succeed.

I have a sneaking suspicion that Substratum is running out of money. I’m not exactly sure how that happened after a $13.8 million ICO funding round with nothing but a whitepaper, but I suspect the team didn’t hedge enough of the raised capital to USD. In a Medium post, Substratum stated ICO funds would be hedged in Bitcoin, Ethereum, USDT, and USD — all in 25% portions. I don’t know the nature of Substratum’s internal risk management protocol when it comes to spending, but observing the transactions in the crowdsale wallet reveals some interesting things.

- December 21, 2017 — 800 ETH (~$704,000) transferred.

- January 5, 2018 — 200 ETH (~$215,000) transferred.

- January 18, 2018 — 1,000 ETH (~$1,100,000) transferred.

I think this selling activity is normal because it took place at the height of a bull market. The crypto frenzy wasn’t going to last forever, and selling to USD at this time was a smart way to reduce risk. Just for reference, ~$2 million worth of ETH was liquidated on the Gemini Exchange between January 18 and December 21.

- April 24, 2018 — 200 ETH (~$140,000) transferred.

- May 10, 2018 — 200 ETH in 2 tx (~$153,000) transferred.

- July 18, 2018 — 500 ETH (~$255,000) transferred.

- August 1, 2018 — 200 ETH (~$87,000) transferred.

- August 13, 2018 — 500 ETH (~$161,000) transferred.

- August 26, 2018 — 500 ETH (~$139,500) transferred.

As you can see, the frequency of crowdsale ETH liquidation has increased significantly since the beginning of the summer, with August showing 1,200 ETH liquidated for ~$387,500. To me, the guys at Substratum seem to be true believers in crypto, and Justin Tabb has a history of price-positive and HODL-inspired tweets here, here, here, here, here, and here. On a slightly unrelated note, take a moment to think about how weird it is for an influential crypto CEO to encourage followers to “buy the dip”. Oh wait, I guess it’s okay as long as there’s a “this is not financial advice” disclaimer.

Moving on…

My point is that true crypto believers don’t fall into the psychological profile category of “reasonable people”. There’s a risk spectrum of course, but they all believe crypto will grow more valuable over time. I currently hold 15% of my net worth in crypto, and I fully admit that’s already considered unreasonable from the average person’s perspective. On the extreme end of the spectrum, there are people who fully believe the global banking system is on the brink of collapse, thus justifying a 100% crypto-based net worth. Based on analysis of Justin Tabb’s tweets and typical top-down corporate behavioral confluence, I believe Substratum’s executive team falls somewhere in the middle of the crypto spectrum. This, combined with the psychological and emotional effects of the 2017 bull market, likely led the team to assign a higher spending priority to USD than crypto because they viewed crypto as a more valuable asset at the time. I think this narrative fits the psychological motives behind the liquidation of ETH.

Again, I think the bull market liquidations in December and January were warranted and logical. Following these liquidations, my guess is Substratum went through a large three-month expansion phase that burned a significant amount of USD. April 24 is when it starts getting interesting. By this time, the price of ETH had rebounded to $700 after falling to the $300 range a few weeks earlier. Compared to earlier and later months, April and May’s liquidations amounted to 200 ETH each, which suggests Substratum’s monthly burn rate is approximately $150,000.

It’s interesting to note the two-month liquidation gap between May 10 and July 18 because the first mention of Product 3 that I could find was in a YouTube video and Medium post dated June 9, which happens to be right in the middle of May 10 and July 18. From an outsider’s perspective, it seems like Substratum ran out of USD and didn’t want to commit to constantly liquidating ETH during a clear downtrend. As a result, Product 3 and its ICO was dreamed up and its vague existence was revealed to the public in June. Following the announcement of Product 3, Substratum’s liquidation rate skyrocketed with 500 ETH sold in July and a whopping 1,200 ETH sold in August. July’s 500 ETH figure fits in my hypothesis that the company experienced a brief hiccup in June, thus liquidating twice the amount of funds needed to cover financial commitments for both June and July. August’s liquidation suggests a psychological spending barrier was lifted after it was decided that Product 3 would include an ICO.

During the announcement of Amplify at this month’s SUBLOCC, Justin Tabb stated that they had received $1 million in private investment for R&D and that the team was focused on making Amplify a fully SEC-compliant exchange. From the presentation, it really seems like the team cares deeply about getting on the SEC’s good side. If that were the case, why not just raise the rest of the money in a private sale for accredited investors only? After all, $1 million was acquired through a private investment. If R&D had positive results, I don’t see why it wouldn’t be possible to raise the rest of the money through private sales. There’s an insane amount of money flowing into blockchain right now, and many projects are choosing the private investment route to minimize legal ramifications — this I know firsthand. With a private sale, the team could also theoretically participate in a SUB buyback to demonstrate confidence in their own product. In this situation, everyone wins.

- Community confidence is revitalized after seeing significant private investment into Substratum’s company talent.

- The community receives a strong signal of confidence as a result of a SUB buyback.

- Substratum receives money to do stuff with.

I think the Amplify ICO is public because it wouldn’t attract educated private investors. Stop and think about this. If you had $250,000 to put into a DEX platform, which one would you invest in?

- A DEX being created by the #1 exchange in the world that has extensive experience in crypto-economics, a battle-tested order matching engine, and hundreds of employees focused on making the exchange better.

- A DEX being created by a company with a few dozen employees trying to focus on decentralizing the Internet, competing with Coinbase and PayPal in payments processing, and working on a DEX to “create a complete ecosystem”.

After the Amplify announcement, the community backlash on Telegram and Reddit resulted in full-out damage control here and here. This led Justin Tabb to announce an AMPX airdrop to all SUB holders — an important fact that was suspiciously missing from the original announcement. Why was it missing? I’m not sure, but my guess is that there was no intention of an airdrop in the first place because the team expected a positive community sentiment post-announcement.

Lastly, I am of the opinion that AMPX has zero intrinsic value and it most definitely does devalue SUB. Both tokens are technically equivalent — they are both ERC-20 tokens bound by Ethereum’s technical standards. So where does SUB’s value come from? In the speculative crypto market, a token’s value is derived from investor confidence which is in turn derived from the implied confidence of its issuer — this is why acts of reinvestment like buybacks and token burns are so well received. The fact that the Substratum team made the conscious decision to create the AMPX ERC-20 token out of thin air to use as a fundraising vehicle is an act of psychological devaluation that implies uncertainty and undermines investor confidence in the SUB token.

I would like to see a thorough crypto-economic case study about why AMPX needs to exist other than to serve as a fundraising vehicle. Since SUB and AMPX are both ERC-20 tokens, what is the technical reason why SUB cannot act as a liquidity underpinning on Amplify DEX? Regarding migration over to BridgeChain (a native blockchain), why can’t SUB migrate to BridgeChain with a 1:1 token swap off of the Ethereum protocol? I don’t buy the SEC compliance argument as both SUB and AMPX value is derived from public ICO — not strictly private sale for accredited investors. If AMPX is truly only a fundraising vehicle, why does the team need the money RIGHT NOW when they are already focusing on two projects in two industries. Furthermore, if Amplify is a separate entity, will there be a separate executive team, and what is the business relationship between Substratum and Amplify? Is a parent/subsidiary model in play?

Knowing all of this, I truly believe the AMPX ICO is a fundraiser for the Substratum project. There’s literally no reason to compete in the DEX space unless you’re looking for an easy way out because building a successful DEX is really, really, really hard. Does this all sound like a conspiracy to you? It probably is. Now, consider the following list of 100% real things that I think Substratum should iron out in their current business strategy before pivoting into an entirely new industry.

Public Relations & Marketing

Inefficient and immature communications strategies are often found in startup companies. At this point, Substratum is over a year old in a rapidly evolving industry with no sign of interest in improving their public image and brand. This is completely outrageous after raising $13 million in their original ICO, and the team should not be conducting a second ICO before establishing a suitable communications strategy. Below are a few examples of how Substratum PR mishaps.

Constant Damage Control

It seems like Substratum is constantly in damage control mode. It all started with January 2018’s public beta release following a series of closed alpha tests. The only catch was that the public beta was also private. Normally, when a company releases software as a public beta, it implies a publicly available download with the necessary “this is beta software, use at your own risk” disclaimers. The Substratum team, being the experienced developers they claim to be, should know this. Secondly, the whole community was hyping each other up about this release being a public public beta. If Substratum knew it was going to be a** private** public beta (LOL), why didn’t they just say something?

The latest round of damage control is the backlash about the recent announcement of a second ICO for Substratum’s Amplify DEX. At the moment, many Substratum community members are upset that the DEX doesn’t use the SUB token as a liquidity source. It’ll be interesting to see how the narrative develops over the coming weeks.

Perhaps the most ironic part of Substratum’s PR strategy is their inability to build an unbiased moderation team for Telegram, Reddit, and other social channels. For a project that prides itself in creating a global network free of censorship, its community channels are notorious for constantly banning people with unique opinions that don’t fit in with the price-positive framework of Substratum moderators. Come on guys, you somehow raised $13 million for this project. Consider using some of that money to compensate bagholding moderators so they don’t have to resort to biased oversight to keep SUB price propped up in order to avoid facing the harsh reality of a nearly negative ROI since ICO.

Lastly, any mention of unapproved conversation results in the possibility of memes being created about you. Here’s an example of a community meme effort against me that was circulated in the Substratum Telegram group and community member Twitter accounts (LOL).

Moderators take no action against these price-supporting actions even when they’re obviously targeted at another community member. On the other hand, they are quick to bring out the ban and FUD hammer whenever the word “sell” is mentioned.

AV Issues

If you’ve watched Substratum’s video updates, you’re probably familiar with their never-ending audio issues which are far more consistent than the price of SUB. A good first impression is important for every business — especially one without a concrete product but still finds ways to make comparisons with Apple, the world’s first trillion dollar company known for their never-ending attention to detail. Substratum’s YouTube presence is NOT a good first impression. The videos have unpredictable audio gain levels, lack of frequency and dynamics processing, occasional panned mono audio, and inconsistent camera angles. I would like to reiterate that Substratum had over $13 million in funding to create a good PR image.

In reality, the budget and time required to fix every AV issue are $300 and half an hour. All the team had to do was purchase a $200 processing box like the dbx 286s to make Justin’s voice sound authoritative, sexy, and professional. If they needed help, they could’ve hired someone for $100 to install it. Regarding the panned audio issue, simply don’t pan the audio or record in dual channel mono. To fix the camera angle, just don’t move the camera. In other words, half an hour and a mere investment of 0.0023% of ICO funding could’ve made the project look 100x more professional.

Damn, that’s a good ROI.

SEO Strategy

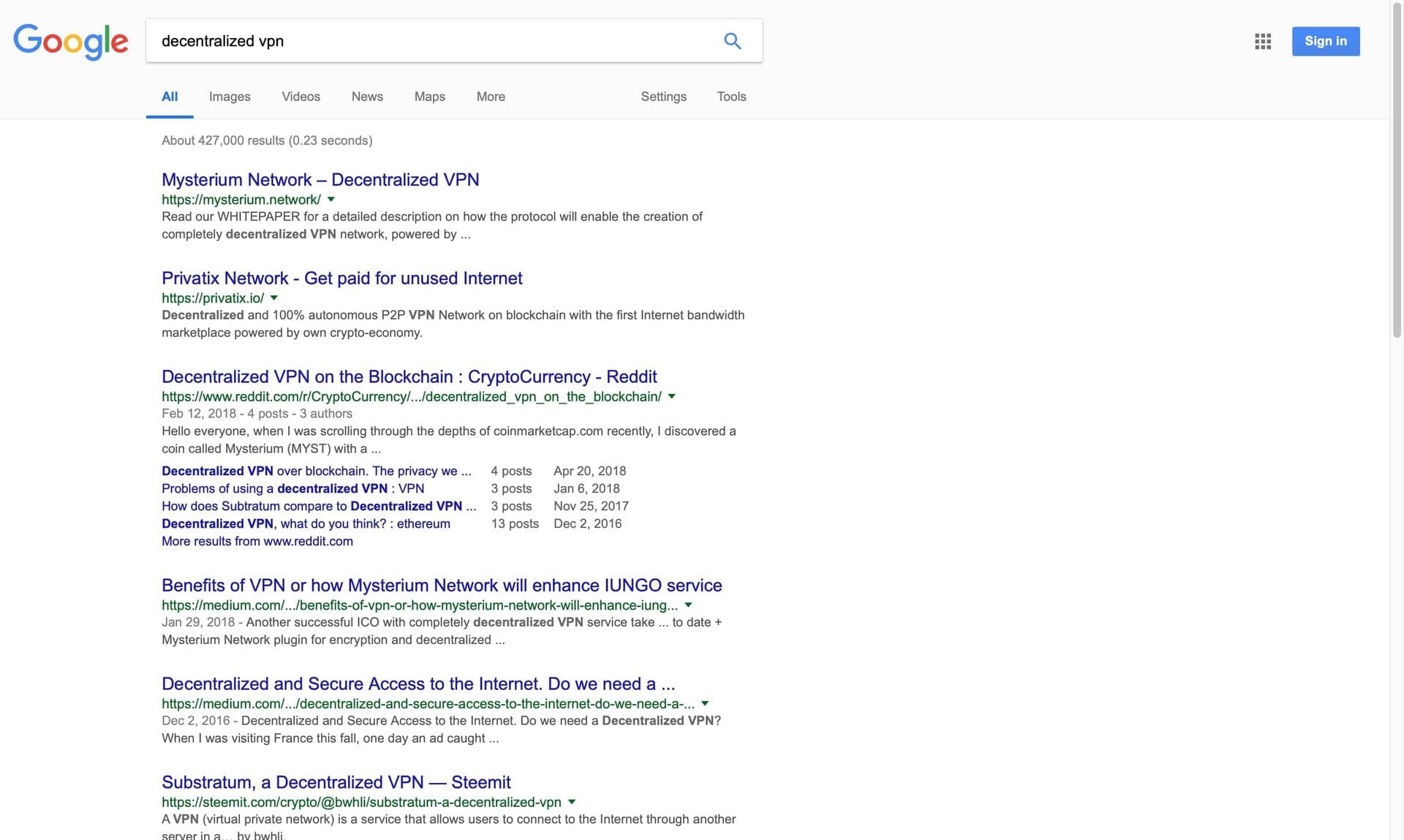

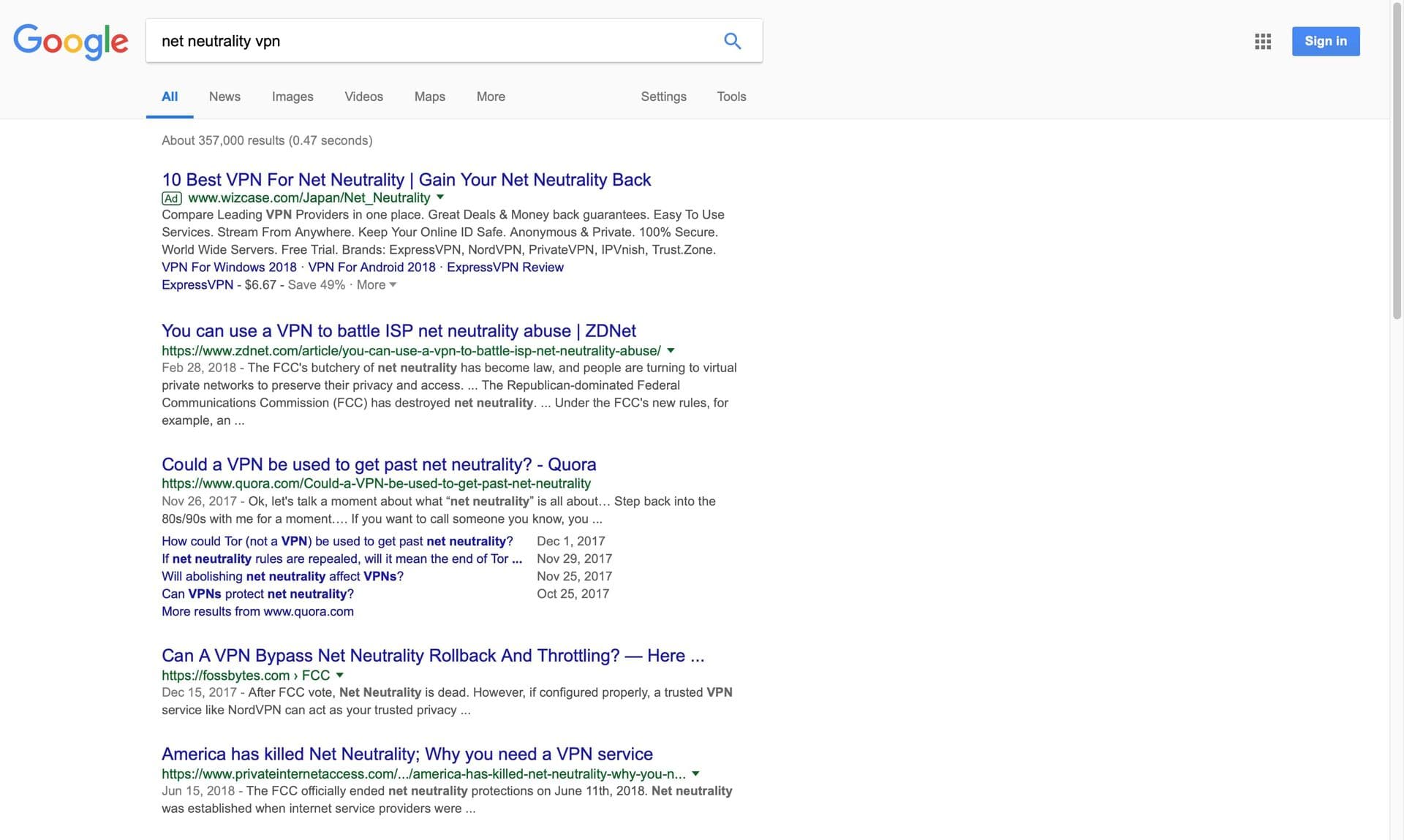

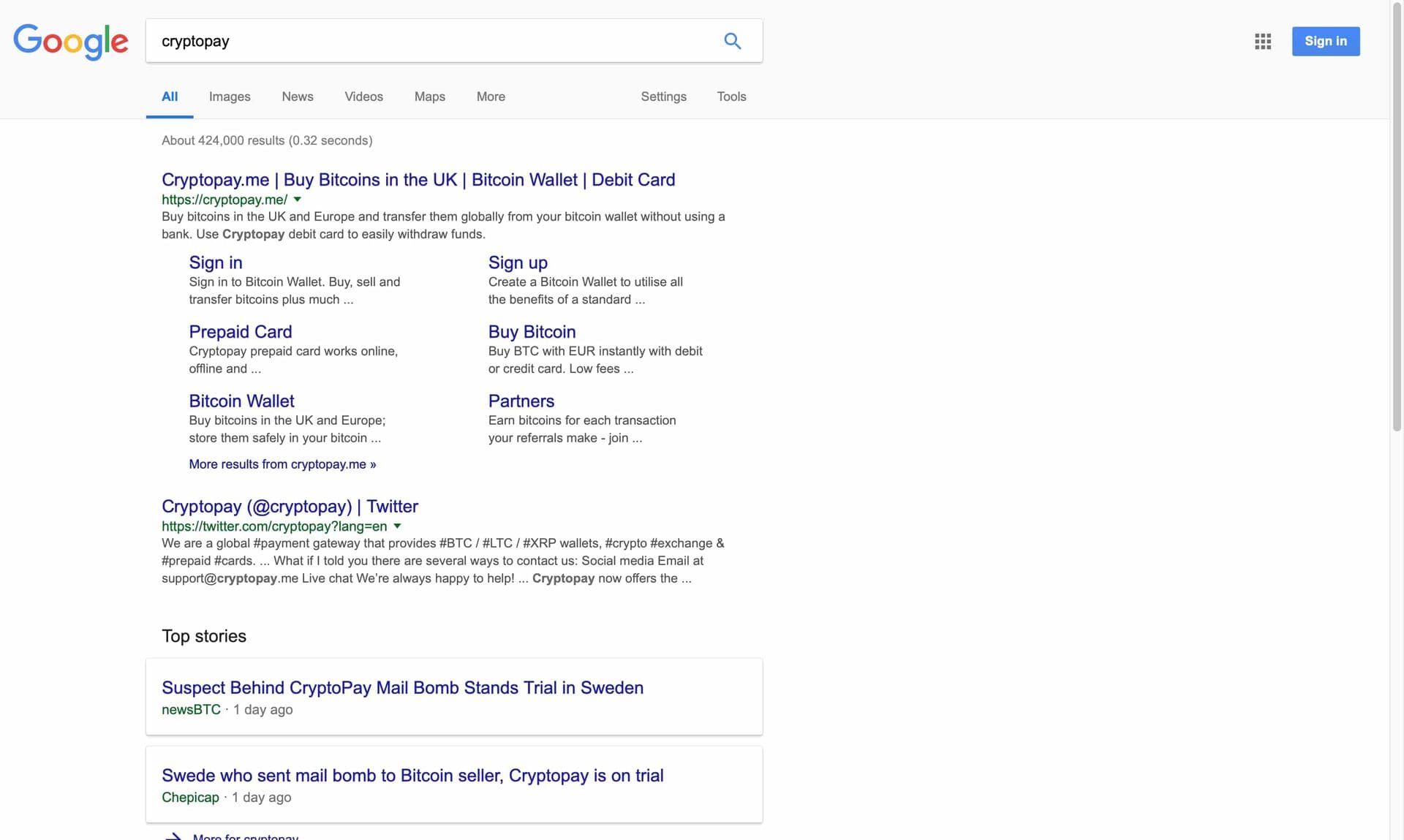

Substratum’s branding strategy has revolved around a decentralized VPN-like service, battling net neutrality, and a payment processing platform called CryptoPay. Unfortunately, this is not reflected in their SEO (search engine optimization) strategy.

Here’s a Google search for “decentralized VPN”. Worst of all, the #1 spot goes to another blockchain project called Mysterium. Interestingly enough, the only SEO title containing the word “Substratum” on the first page of results is one of my articles on Steemit titled “Substratum, a Decentralized VPN”. This tells me that it’s infinitely easy to rank for “decentralized VPN” right now, but the team is choosing to neglect this.

Next up is a search for “net neutrality VPN”. The Substratum team has been constantly talking about fighting net neutrality and Internet censorship. Over the past few years, the term “VPN” has become synonymous with browsing the web freely, mostly thanks to publicity of high-level VPN usage in China. Thus, it would be logical for people to search for “net neutrality VPN” when searching for ways to get past net neutrality restrictions. This was a perfect situation for Substratum to capitalize on, but as you can see, there is nothing about Substratum on the first page of search results.

This last example is pretty self-explanatory. I know a stable release of CryptoPay is still pretty far off, but there’s literally nothing about the platform on the first page of search results. Even worse, the number one spot has already been occupied by another global payment gateway with the same name. Cryptopay.me (the other CryptoPay) even has their own cryptocurrency called CPAY. It’s currently #1114 in market cap rankings, but it still exists. In my opinion, this is going to get very confusing very quickly for the average consumer. I don’t profess to be a branding expert, but I think a name like “SubstratumPay” would’ve been an infinitely better choice — it builds and solidifies brand image and doesn’t create unnecessary competition and confusion with an already established service.

Looking back at posts from a year ago on Substratum’s official blog, it looks like there was a small effort at content creation. For example, this post talks about how to use an idle computer to contribute resources to the Substratum network, and this one discusses how Substratum may provide more affordable web hosting in the future.

Fast forward to August 2018 and this is what we see — minimal effort, unnecessary use of capitalization, close to zero useful information, and a simple video embed. Think about why people visit a blog from a UX perspective. Traditionally, blogs are places where people READ information. If they wanted to watch a video, they’ll go to the YouTube channel. Thus, what is the point of embedding a video with no descriptive text to accompany it? This isn’t just a UX argument though. From an SEO perspective, recycling the video into text is a super easy way to attract Google’s search spiders. Some of Substratum’s videos actually contain useful information, and it would be trivial to transcribe the audio into real blog posts to boost Google search rankings.

In the emerging blockchain and crypto industry, the companies who get the most traction early on have a much higher chance at long-term success. In 2018, “getting traction” partially means establishing a good SEO profile. Google has become the go-to place for finding solutions. If you’re a blockchain company built around giving people a solution to a problem, you better get your a** in the top three search results. Otherwise, you’ll never be exposed to the 99.9999% of people who aren’t in your Telegram group and Subreddit, and you can probably kiss the mass adoption dream goodbye. In my opinion, Substratum’s marketing department should be aggressively doing the following.

- 2-3 in-depth case studies a week about the state of global Internet censorship, cartelization in the web hosting industry, potential effects of net neutrality in the USA, security audits of popular VPN services, and more. The goal here isn’t to shill SubstratumNode, but to establish the project as an authority in the Internet services industry. If people read a well-researched post about Internet censorship on your company blog, they’ll probably be interested in learning about your product. Why? Because it shows you care.

- Reaching out to mainstream media outlets to collaborate on content about global censorship and oppression. On a technical level, the team should be actively securing inbound links with relevant anchor text. I think this would be a fairly easy pitch in today’s political climate — especially in the USA. Many mainstream publications (NY Times, Washington Post, etc.) are severely left-leaning. Take advantage of this and talk to them about fighting censorship and oppression. They’ll eat it up you may just end up getting some first-class SEO link juice.

Substratum Ambassador Program

In a brief moment of excitement a few months ago, I applied to become a Substratum ambassador to promote the project in Asia. I received the following email in June about acceptance into the program.

Two and a half months have passed since this email, and there have been no updates about the Ambassador Program. Perhaps I got blacklisted for expressing valid opinions, but I presume this is just another example of Substratum getting hyped up about an idea and not following through.

Lack of Email Followup

In late May, I was connected to the Substratum team by a Telegram moderator to conduct an email interview. At the time, I felt like the quality of the project was going downhill and wanted to speak to the team firsthand about my concerns. I received the following reply from Christian Pope.

Hey Brian, I am told you are looking to do an interview with Substratum. Can you give me a little more detail? Thanks,

Christian Pope

Chief Marketing Officer

Substratum Network

I responded and expressed my interest in conducting an email interview along with a podcast, but didn’t end up getting a response. To me, this is unacceptable. A company’s chief marketing officer is literally tasked with responding to media requests. Lesson #1 in PR — don’t be the one to initiate the conversation if you don’t plan to follow up. If the Substratum team or community ever end up seeing this post, I bet they’ll justify this by saying something like, “Dude you’re not even a famous blogger with millions of views each month. Why would Substratum want to talk to you?” I suppose that’s true, and this communications oversight would be much less unacceptable if Substratum’s market department was truly overflowing with inquiries from the likes of Gizmodo, TechCrunch, and the New York Times. That’s just not the case at the moment even though Substratum is supposedly the next Apple, Inc.

The Good Things

I still think Substratum’s original idea about decentralizing the Internet and incentivizing users to contribute web hosting resources is excellent. Furthermore, Substratum’s frequent YouTube updates are also commendable. With that said, it’s clear that the company is currently understaffed and underfunded to pursue three gigantic industries. I don’t think there’s a legitimate argument against this when relatively well-funded and well-staffed entities like Binance and Coinbase are also facing significant roadblocks. In the end, I don’t see the downside in focusing on making one excellent product, monetizing it, and then using profits to pursue other endeavors. At least there’s some cash flow in that scenario.

To the people who say adding more developers will not speed up the development of SubstratumNode and SubstratumHost — I completely believe you, and that’s why all my concerns are marketing-related. Mass adoption doesn’t happen without mass marketing and things like top SEO ranking can often take longer than expected. Based on the way things are going now, I can easily envision a future where Substratum releases a great product and starts the PR effort after the fact. What’s the plan for cash flow during that in-between time? With a stable release less than a year away (I think), why not start the PR effort now to establish keyword dominance for relevant search terms?

Conclusion

There was a time where I considered Substratum to be a top project in the space, but so many things have changed since then. The team’s continued PR failures, lack of attention to detail, and an inability to focus on doing one thing right is a huge turn-off from an investor perspective. Justin Tabb is a man of many dreams as revealed by CMO Christian Pope’s damage control response on Reddit. In conclusion, I would like to offer these two tidbits of advice to Substratum.

- Don’t pursue too many dreams at once unless you enjoy nightmares.

- Stop comparing your company to Apple. You are not Steve Jobs.

Update: As of September 1, 2018, I’ve been banned from the Substratum Telegram channel and subreddit for expressing an unapproved opinion.