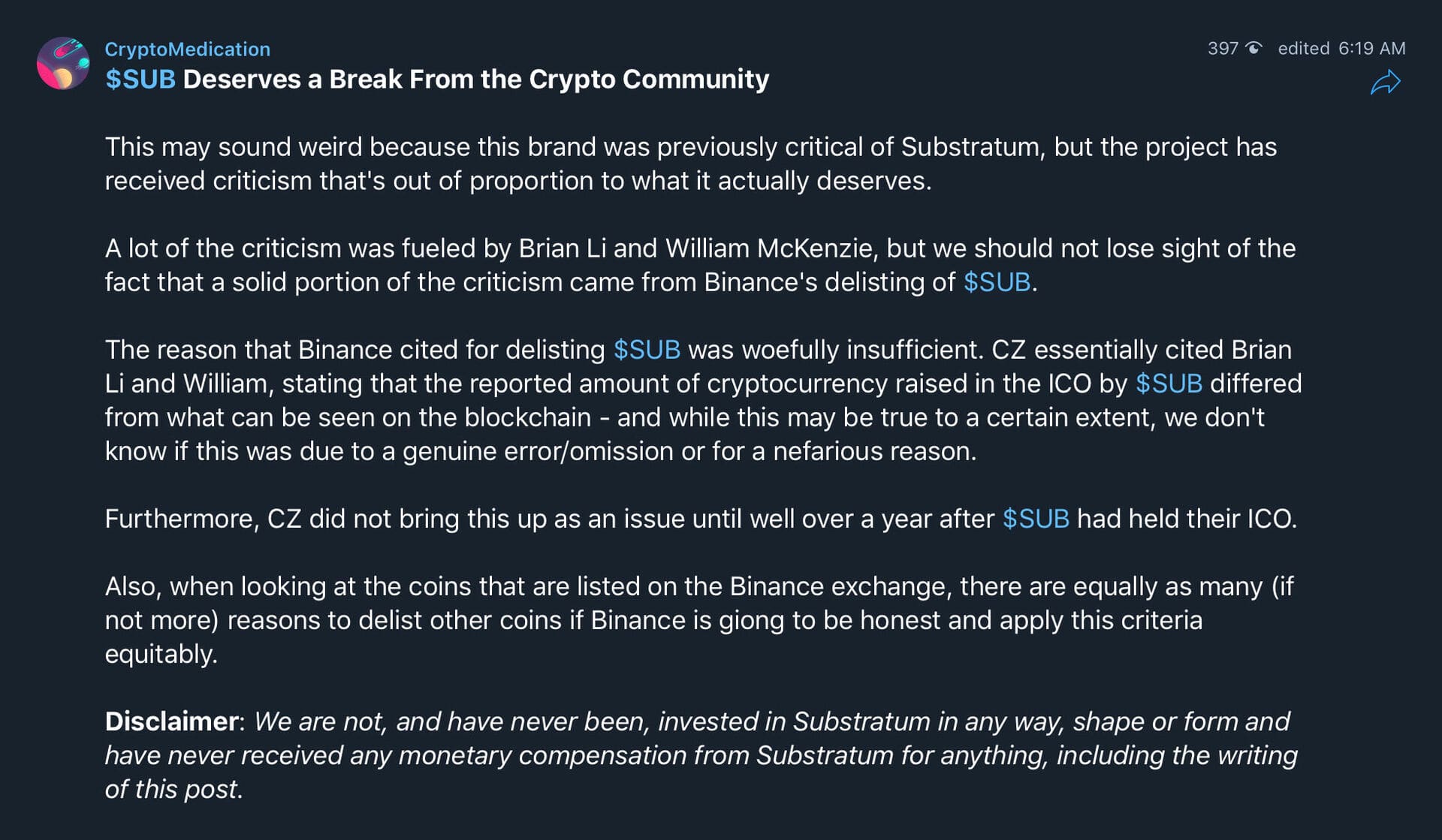

Earlier today, James Edwards (a.k.a. Zerononcense, ProofOfResearch, CryptoMedication, etc.) released a statement titled “$SUB Deserves a Break From the Crypto Community” on his Telegram channel. Similar to Edwards’ previous inaccurate accusations regarding my affiliation with Torque Ventures (there is no affiliation in reality), his latest round of nonsense is also, unsurprisingly, littered with inaccuracies – once again, laughably ironic for someone who calls himself “ProofOfResearch”. Below is Edwards’ statement about Substratum.

$SUB Deserves a Break From the Crypto Community This may sound weird because this brand was previously critical of Substratum, but the project has received criticism that’s out of proportion to what it actually deserves. A lot of the criticism was fueled by Brian Li and William McKenzie, but we should not lose sight of the fact that a solid portion of the criticism came from Binance’s delisting of $SUB. The reason that Binance cited for delisting $SUB was woefully insufficient. CZ essentially cited Brian Li and William, stating that the reported amount of cryptocurrency raised in the ICO by $SUB differed from what can be seen on the blockchain - and while this may be true to a certain extent, we don’t know if this was due to a genuine error/omission or for a nefarious reason. Furthermore, CZ did not bring this up as an issue until well over a year after $SUB had held their ICO. Also, when looking at the coins that are listed on the Binance exchange, there are equally as many (if not more) reasons to delist other coins if Binance is giong to be honest and apply this criteria equitably. Disclaimer: We are not, and have never been, invested in Substratum in any way, shape or form and have never received any monetary compensation from Substratum for anything, including the writing of this post.

Let’s break down ProofOfResearch’s lack of research.

The reason that Binance cited for delisting $SUB was woefully insufficient. CZ essentially cited Brian Li and William, stating that the reported amount of cryptocurrency raised in the ICO by $SUB differed from what can be seen on the blockchain - and while this may be true to a certain extent, we don’t know if this was due to a genuine error/omission or for a nefarious reason.

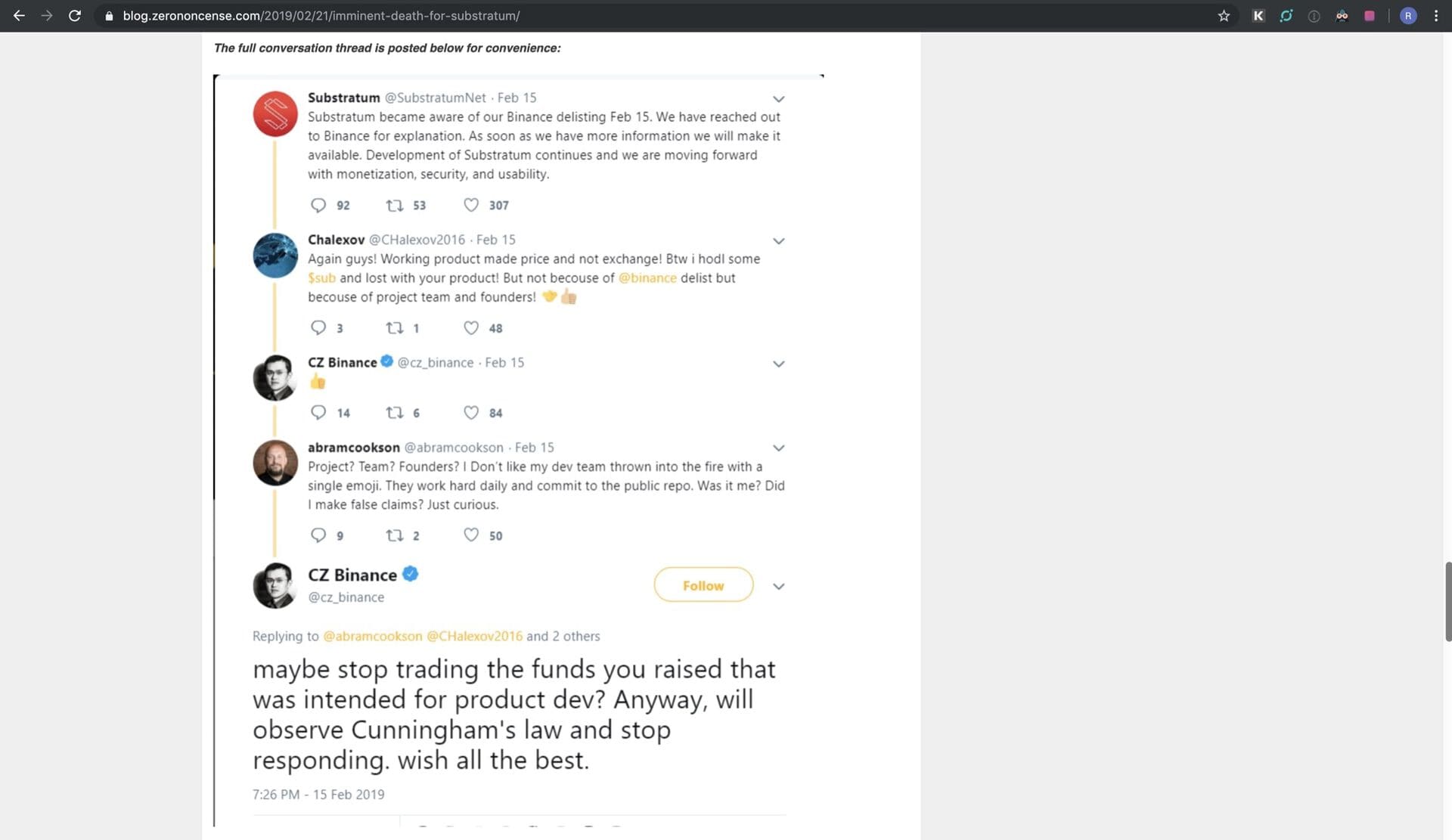

Actually, Substratum’s misreported ICO funds, while concerning, is not what CZ referred to in his conversation with Substratum on Twitter.

CZ’s tweet clear states, “maybe stop trading the funds you raised that was intended for product dev,” which has nothing to do with the misreporting of ICO funds. Furthermore, CZ did not cite me or William McKenzie in any of his tweets. Funnily enough, James Edwards shared this exact same Twitter conversation in a post titled “Imminent Death for Substratum? on his blog. Perhaps Edwards should do some research on his own blog before publishing inaccuracies on his Telegram channel next time.

So, what was CZ referencing in his tweet about Substratum trading funds? On December 17, 2018, Substratum CEO Justin Tabb released a YouTube video where he stated the following.

Um, so basically what’s happening now is that those simulations continued to indicate that Ethereum is going to continue its downward trend, obviously, and test all the way down to $60. So, we are going to not cash in, but begin basically attempting to trade up so we can further out position as long as possible… So we’re taking advantage of the trader that we have in full-time, and we are going to be actively trading a portion of the Ethereum so that we can trade up basically. So we can sell at the top of the bands, and buy at the bottom of the bands… So, we will be actively doing that and you can actually watch that happen, but it’s just to further our position, so we should be able to pick a percentage of Ethereum when we re-buy in, and then once the market turns back bull, which I believe it will in a couple months, then our position will be that much better and we’ll be able to further the time that we have to continue building the products that we want to build until we get cash flow positive, which we expect to do next year.

Simply put, this statement from Justin Tabb is not up for interpretation. It’s clear that Tabb intended to use his “full-time” trader to trade ETH on secondary markets. He even revealed their Bollinger Band trading strategy – “sell at the top of the bands, and buy at the bottom of the bands.” In reality, here’s how Tabb’s timing worked out for Substratum.

Regarding Tabb’s statement about Substratum getting “cash flow positive” this year, that’s probably not going to happen. SubstratumNode V1, which was originally scheduled for an EOY2017 release is still in development as we speak. Considering Substratum has 0**.**020894 ETH left in its wallet, it doesn’t look like the team will be cash-flow positive anytime soon.

Furthermore, CZ did not bring this up as an issue until well over a year after $SUB had held their ICO.

Yes, CZ “did not bring this up as an issue until well over a year after $SUB had held their ICO” because CZ did not bring this up as an issue at all. Once again, CZ only referenced the trading of ICO funds, and not the misreporting of ICO funds. Justin Tabb’s trading announcement happened in mid-December, and SUB was delisted two months later in mid-February.